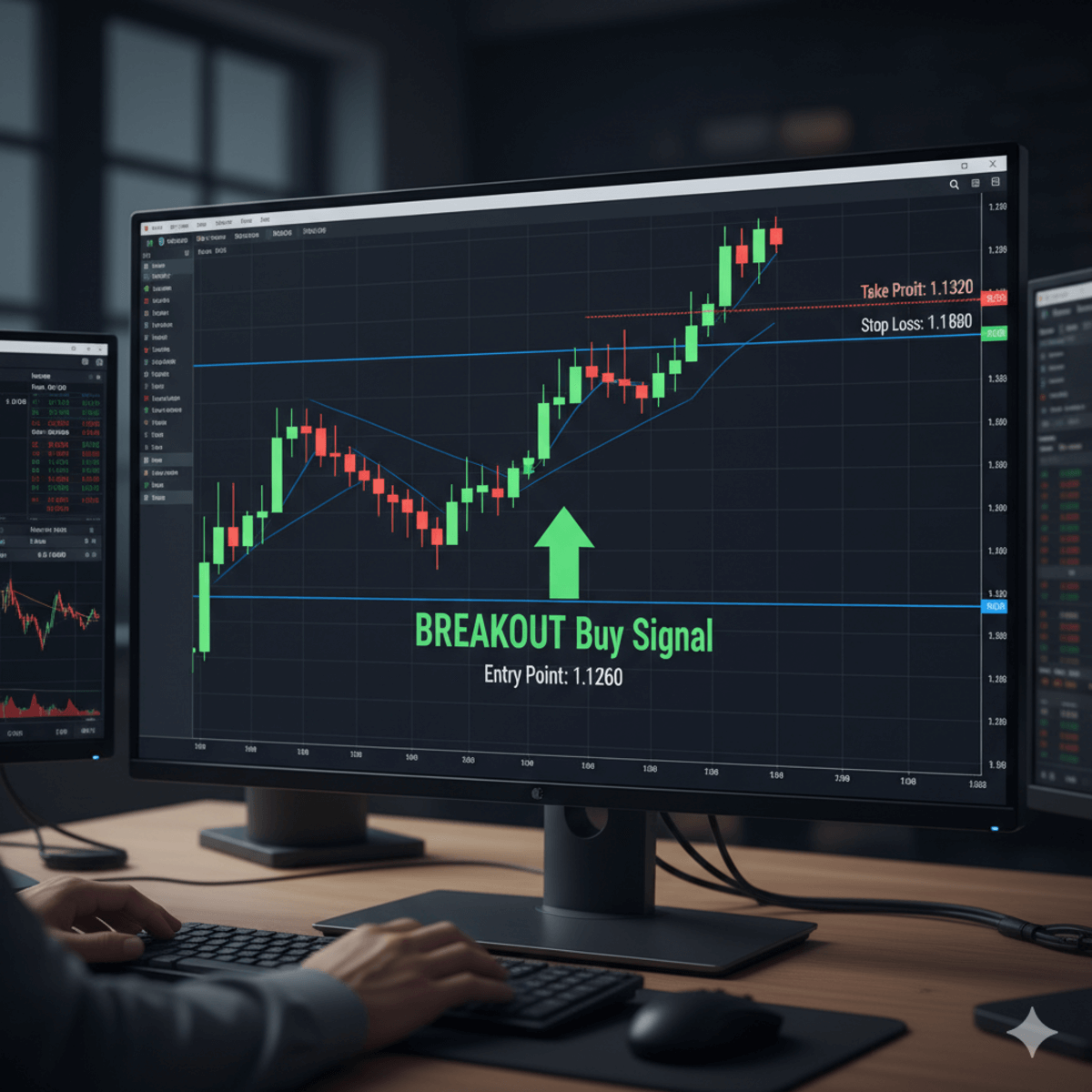

One of the fastest ways to grow your forex account is by breakout trading. This strategy is simple: wait for price to break out of support or resistance, then ride the momentum.

Learn the Secret of Forex Trading, Click here to download a free e-book now

Breakouts often lead to big moves because traders and institutions are waiting for the same levels. When those levels break, the market runs fast — and you can join the move.

What is Breakout Trading?

Breakout trading means entering the market when price pushes past a key level.

- Above resistance = breakout to the upside.

- Below support = breakout to the downside.

The goal is to catch the new trend early before it runs too far.

How to Trade Breakouts Step by Step

- Find strong levels — Mark support and resistance zones where price keeps bouncing.

- Wait for a strong breakout candle — A big bullish candle above resistance or bearish candle below support.

- Confirm with volume or retest — Volume helps, or wait for price to pull back and retest the level.

- Enter the trade — In the direction of the breakout.

- Protect your Equity — Place stop loss just outside the broken level.

Example: GBP/USD is stuck between 1.2500 (support) and 1.2600 (resistance). A strong candle closes above 1.2600. That’s your breakout. Enter long with stop below 1.2600.

Tips for Successful Breakout Trading

- Don’t trade every breakout: Some are fakeouts. Wait for confirmation.

- Bigger timeframes are better: Breakouts on 4H or daily charts are stronger than on 1-minute charts.

- Use tight risk management: Markets can snap back quickly.

Common Mistakes to Avoid

- Entering too early: Let the candle close beyond the level.

- Ignoring the bigger trend: Trade breakouts in the same direction as the trend for higher success.

- No stop loss: Fakeouts happen. Always protect yourself.

FAQ

Q: Which pairs work best for breakout trading?

Major pairs like EUR/USD, GBP/USD, and USD/JPY. They have good liquidity and cleaner moves.

Q: Should I use indicators?

You can, but they’re not required. Price action and volume are enough.

Q: What’s better, breakout entry or retest entry?

Both work. Retests are safer, but pure breakout entries catch moves earlier.

Bottom Line

Breakout trading is a simple way to catch powerful market moves. Focus on clear support and resistance levels, wait for strong breakouts, and manage your risk.