Most traders lose money because they chase the market. They see price moving fast and jump in late—only for the market to reverse and stop them out. Smart traders know better. They wait for the market to breathe. That pause, that dip against the trend, is called a pullback—and trading it can completely change your results. In this guide, we’ll cover what pullback trading is, why it works so well, and step-by-step strategies you can use today.

Learn the Secret of Forex Trading, Click here to download a free e-book now

Key Summary

- Pullback trading means entering after price temporarily moves against the main trend.

- It gives better entries, smaller stop losses, and higher win rates.

- Tools like moving averages, Fibonacci retracements, and candlestick patterns help confirm pullbacks.

- Patience and discipline are key—wait for price to come to you.

What is Pullback Trading?

Pullback trading is when you enter the market during a temporary counter-move in a trend.

For example:

- In an uptrend, price moves higher, then pulls back slightly before continuing upward.

- In a downtrend, price falls, then bounces upward a little before continuing down.

- Instead of buying at the top or selling at the bottom, you use the pullback to get a better entry price with less risk.

Think of it like buying a product at a discount—you’re still following the main trend, but at a cheaper price

Why Pullback Trading Works

- Trends rarely move straight: Markets breathe. Pullbacks are natural pauses.

- Lower risk entries: Buying or selling at a pullback gives you tighter stop losses.

- High probability setups: If the trend continues, pullback entries often catch big moves.

Pullback Trading Strategy (Step by Step)

Identify the Trend

- Use higher timeframes (4H or Daily).

- Simple rule: higher highs & higher lows = uptrend; lower highs & lower lows = downtrend.

Wait for the Pullback

- Look for price to retrace to support, resistance, moving averages (20 EMA, 50 EMA), or Fibonacci levels (38.2%, 50%, 61.8%).

Look for Confirmation

Price action signals like:

- Bullish engulfing / pin bar (for buys).

- Bearish engulfing / shooting star (for sells).

- Volume spikes or trendline touches can also confirm.

Enter the Trade

- Enter in the direction of the main trend.

Example: In an uptrend, wait for a pullback to support, then buy when a bullish candle forms.

Protect Your Equity

- Stop loss goes below the pullback low (for buys) or above the pullback high (for sells).

- Use at least 1:2 risk-to-reward ratio.

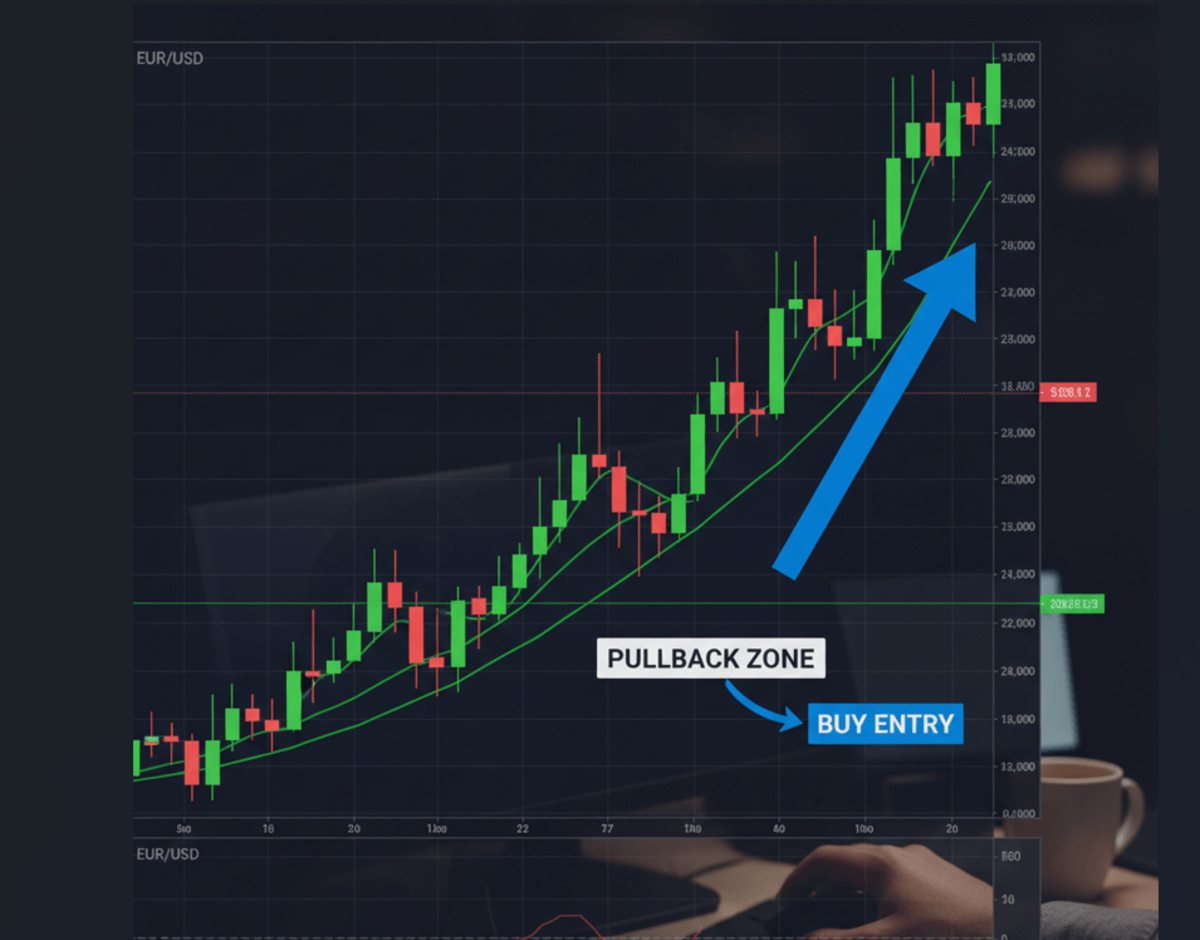

Example of Pullback Trading

Let say EUR/USD is in a strong uptrend. Instead of buying at the top, you wait until price pulls back to the 50-day moving average. At that level, a bullish engulfing candle forms. You buy. The trend continues upward, and you ride the move with less risk.

Common Mistakes in Pullback Trading

- Entering too early (before the pullback is complete).

- Ignoring the bigger trend (trading against it).

- Not using stop losses.

Bottom Line

Pullback trading is about patience and discipline. Instead of chasing price, you wait for it to come to you. It’s a simple yet powerful way to trade forex with less stress and more accuracy.

FAQ on Pullback Trading

Q: Which timeframes work best for pullback trading?

A: 1H, 4H, and Daily charts give cleaner pullbacks. Lower timeframes have too much noise.

Q: Can beginners use pullback trading?

A: Yes, it’s simple to learn and safer than chasing trends. Start with major pairs and higher timeframes.

Q: What’s the difference between pullback trading and breakout trading?

A: Breakout trading catches moves at new highs/lows, while pullback trading waits for a dip before joining the existing trend.

Q: Do I need indicators for pullback trading?

A: Not necessarily. Price action is enough, but tools like moving averages or Fibonacci retracements can help confirm.

Q: How do I know if a pullback is actually a reversal?

A: Watch higher timeframes. If the trend structure (higher highs, higher lows) breaks, it may be a reversal.