Fondly, I call the USDJPY pair “East Meets West.” The U.S. dollar represents a Western risk currency, while the Japanese yen is widely known as a safe-haven Eastern asset. Trading USDJPY is like watching how two opposing economic powers interact in real time. Typically, the USD gains strength when global economic conditions are stable, while the JPY strengthens during periods of uncertainty and risk aversion. This contrast makes USDJPY one of the most fascinating pairs to trade, though not without its own moments of unpredictability. As I reviewed my 2025 trading records, I felt compelled to share my USDJPY trading journey—the wins, the frustrations, and the lessons that reshaped my approach to the forex market.

Trading USDJPY has been a life-changing decision for me. It brought hope, structure, and a renewed sense of purpose. But it also came with moments where it felt like I was testing my limits emotionally and financially. This journey reinforced a truth many traders learn the hard way: forex trading is a serious career path that requires preparation, patience, and a sustainability plan, especially before consistent profitability is achieved. Despite the challenges, I closed 2025 successfully and stepped into 2026 with clarity and confidence

My USDJPY Statistics in 2025: Over 59 Trades Taken

My USDJPY journey officially began in late July 2025. While teaching, one of my students pointed out an opportunity on USDJPY. At the time, I was primarily trading EURUSD, but something about USDJPY caught my attention.

So, I decided to do my homework by assessing this new asset’s number of pips per week per day, its margin amount per leverage, its fundamentals and other trading factors that I deemed necessary and to my surprise, it fell within my trading choice for any pair. So, I decided to add it to my watchlist and trade.

Between July and December, I have taken over 59 trades on USDJPY on two of my accounts and that accounted for more than 70% of my total trading history in 2025. From these 59 trades, over 40% were winning trades while 60% were losers. With a minimum risk to reward of 1:5, I ended up having a profitable year.

How I traded USDJPY through 2025

One of the guiding principles for my trading spree is price action. By this, I mean using the movement of price to judge a market. While every trader is unique in their trading methodologies, I tweak my analysis by looking at some of the fundamental factors behind a successful trading adventure. This includes but not limited to the following:

1. Multiple timeframe analysis

Multiple timeframe analysis is all about breaking down an analysis from a particular time frame to a lesser timeframe, usually an entry or exit time frame. For me, I prefer to work with the weekly, four hour and fifteen minutes timeframe. That is how I do my multiple timeframe analysis.

In the weekly, I look for a series of things such as current trend, the weekly open price, potential opposing fair value gaps and the current candle stick patterns. While this gives me a hint to understand what price is doing, it also tells a story on what I should look out for and when I should look out for them. In the four hours (4H), I looked for price structure, inducement zones, and price patterns such as falling and rising flags. In fifteen minutes (M15), I watch out for potential entry and exit points as shown in the picture above.

2. Understanding fair price

Fair price simply means identifying a price level that can be assumed as fair to both buyers and sellers. In an uptrend or a downtrend, I pick my fair price level using fair value gap or price imbalance and/or Fibonacci tool.

From the illustration used in these pictures, I took the trades from the small zone using the Fib ratio that fell below the 61.8% ratio. While this has helped me to identify levels where market pullbacks will most likely end and the real trend resume, it gave me the confidence to swing and hold my trades progressively through the weekends and holidays. Well, it did incur some swap charges.

3. Trading from zones

This is one of the safest places I trade from. This is because, it gives me an edge to ride the trend, while targeting the next swing high or low in the market. Usually, I love to swing and whenever the market return to a zone, especially a higher time frame zone, it gives me so much delight to know that I can take a trade, hold it for several hours or a few days, leverage more on the minor pull backs and add more trading positions while aiming at the opposing zone for an exit. For me to trade from a zone, I could catch a R:R of 1:10 or more. The picture below shows one of the trades I took last year with a R:R of 1:12 as before and after.

From 140.100 Low to 158.800 High in 2025

Looking at the USDJPY chart again brought me a place of wonder. Firstly, because the market has really not made a prominent movement in terms of price change. This is what I mean. The market opened the year at a price of 157.200, pushed to a yearly high of 158.800, dropped to a low of 140.100 in April and rallied back to close at 1567.800 and closed it at that same price. Relatively, if you consider the difference between the open price and the close price, one would see that USDJPY successfully created a doji candle – which many could call a rejection spinning top- for the entire year.

2025 USDJPY Market Overview

- Yearly open: 157.200

- High: 158.800

- Low: 140.100

- Yearly close: 157.800

Interestingly, USDJPY formed a yearly doji / spinning top, signaling rejection and indecision despite strong price swings

My 2026 Forecast for USDJPY

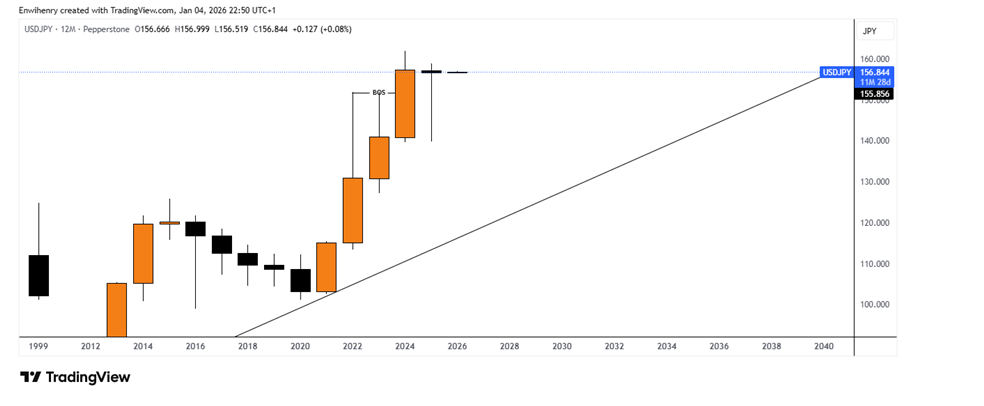

Looking at that yearly chart, one would notice that the entire 2025 formed a rejection candle with a strong bullish momentum. However, that is not to say conclusively that the market will buy. Historically, a spinning top represents a bearish candle with high bullish momentum. While this could also be interpreted as a bearish sign for the bears to come into the market, I will say that both signals are correct as they are valid in its interpretations.

However, considering the fundamentals of USD and JPY, one can notice that USD has actually been weakening in 2025, likewise JPY. Additionally, with the insurgencies and trade wars, it will not be out of place if the USD weakens further. More so, with the new government that will be leading Japan this January in a coalition with the Japan Innovation Party, focusing on economic reforms, wage growth, and security amid challenges like U.S. relations under President Trump, it is most likely that a lot will change for the economy of Japan. Hence, fundamentally, the 2026 trend may favour JPY rally. But then, technically, I would us this information to look at the fair values of both currencies and give a proper outlook before taking opening positions. This will mean journaling the open and close prices for this pair, looking out for fair value gaps through the monthly and weekly timeframes, and watching out for further geopolitical events that will help me confirm my findings. With this outlook, I believe my 2026 will land me on a more profitable side.

Final Thought on my 2025 USDJPY trading journey

Looking back on my USDJPY trading journey, I can confidently say that trading USDJPY can be a worthy asset during strong trending phases—but also a serious test of patience during choppy or uncertain market conditions. While forex trading naturally comes with risk, it’s important to pay close attention to key fundamentals, especially on the USD side. High-impact events such as NFP, CPI, PPI, FOMC, and PMI releases can significantly influence price movement and create both opportunity and danger. These moments can be rewarding for experienced traders, but they may prove risky for first-timers (not necessarily beginners). The lesson from my USDJPY trading journey is simple: trade cautiously, stay informed, and always act with clear intent.

Bottom Line

My USDJPY trading journey has taught me that profitability is not just about catching big moves—it’s about understanding context, respecting fundamentals, and managing risk with discipline. USDJPY can deliver exceptional returns when traded with preparation and patience, but without structure, it can quickly become unforgiving. Whether you are trading trends or navigating uncertainty, the bottom line is this: approach USDJPY as a serious trading instrument, not a gamble, and let strategy—not emotion—guide every decision.

Contact Me

If this is your first time reading my work, welcome to the blog. This is a space where I consistently share educational, practical, and engaging content around trading and market psychology. If you’d like to connect, ask questions, or have meaningful conversations about trading—especially full-time trading—you can reach me via email at juvirtrades@gmail.com.

And if you’ve been following my articles already, welcome officially to 2026. My hope is that we continue to grow together as traders, sharpen our skills, and keep stacking green pips along the way.

Here’s to a profitable and disciplined year ahead. Happy New Year