If you want to succeed as a forex trader, you must understand how to calculate pips, lots, and leverage. These three elements determine how much you make (or lose) in the market. Without mastering them, you risk blowing your account before you even build consistency.

In this guide, we’ll break down what pips, lots, and leverage mean, how to calculate them, and how to use them responsibly in your forex trading journey.

What is a Pip in Forex?

A pip (short for “percentage in point”) is the smallest price movement in a currency pair.

- For most forex pairs, one pip = 0.0001.

- For JPY pairs, one pip = 0.01.

Example:

If EUR/USD moves from 1.1000 to 1.1005, that’s a 5-pip increase.

Understanding pip values helps you measure your profits and losses accurately.

What is a Lot in Forex?

A lot represents the trade size or volume you are trading.

- Standard Lot = 100,000 units (1 lot)

- Mini Lot = 10,000 units (0.1 lot)

- Micro Lot = 1,000 units (0.01 lot)

Example:

- Trading 1 standard lot on EUR/USD means you are trading €100,000.

- With 1 pip = $10 on a standard lot, a 20-pip move = $200 profit or loss.

Lots determine how much money each pip movement is worth in your account.

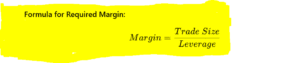

What is Leverage in Forex?

Leverage allows you to control a large position with a smaller amount of capital.

Example:

- With leverage of 1:100, you can control $100,000 in trades with just $1,000 of your own money.

While leverage can magnify profits, it can also magnify losses — making risk management critical.

How Pips, Lots, and Leverage Work Together

Let’s put it all together with an example:

- Trading EUR/USD

- Account Balance: $1,000

- Lot Size: 0.1 (mini lot = $1 per pip)

- Leverage: 1:100

Price moves 50 pips in your favor

Calculation:

50 pips × $1 = $50 profit

If the trade went against you, it would be a $50 loss.

This shows why risk management is key when calculating pips, lots, and leverage.

Risk Management Tip

- Never risk more than 1–2% of your account on a single trade.

- Always calculate position size before entering the market.

- Use stop-loss orders to protect your capital.

FAQs on Pips, Lots, and Leverage

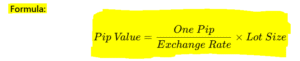

1. How much is 1 pip worth in forex?

On a standard lot, 1 pip = $10. On a mini lot, 1 pip = $1. On a micro lot, 1 pip = $0.10.

2. What lot size should I use with $100?

Stick to 0.01 lot (micro lot). This allows small risk and keeps you in the game longer.

3. Is high leverage good or bad?

High leverage can be both. It increases profit potential but also increases risk. Beginners should use lower leverage (like 1:30 or 1:50).

4. How do I calculate position size?

5. Can I trade forex without leverage?

Yes, but you’ll need a larger account to see meaningful returns. Most retail traders use leverage to maximize small capital.

Final Thoughts

Understanding how to calculate pips, lots, and leverage in forex is the foundation of smart trading. It helps you control risk, plan trades effectively, and protect your capital. Master these basics, and you’ll have the tools to grow steadily as a forex trader