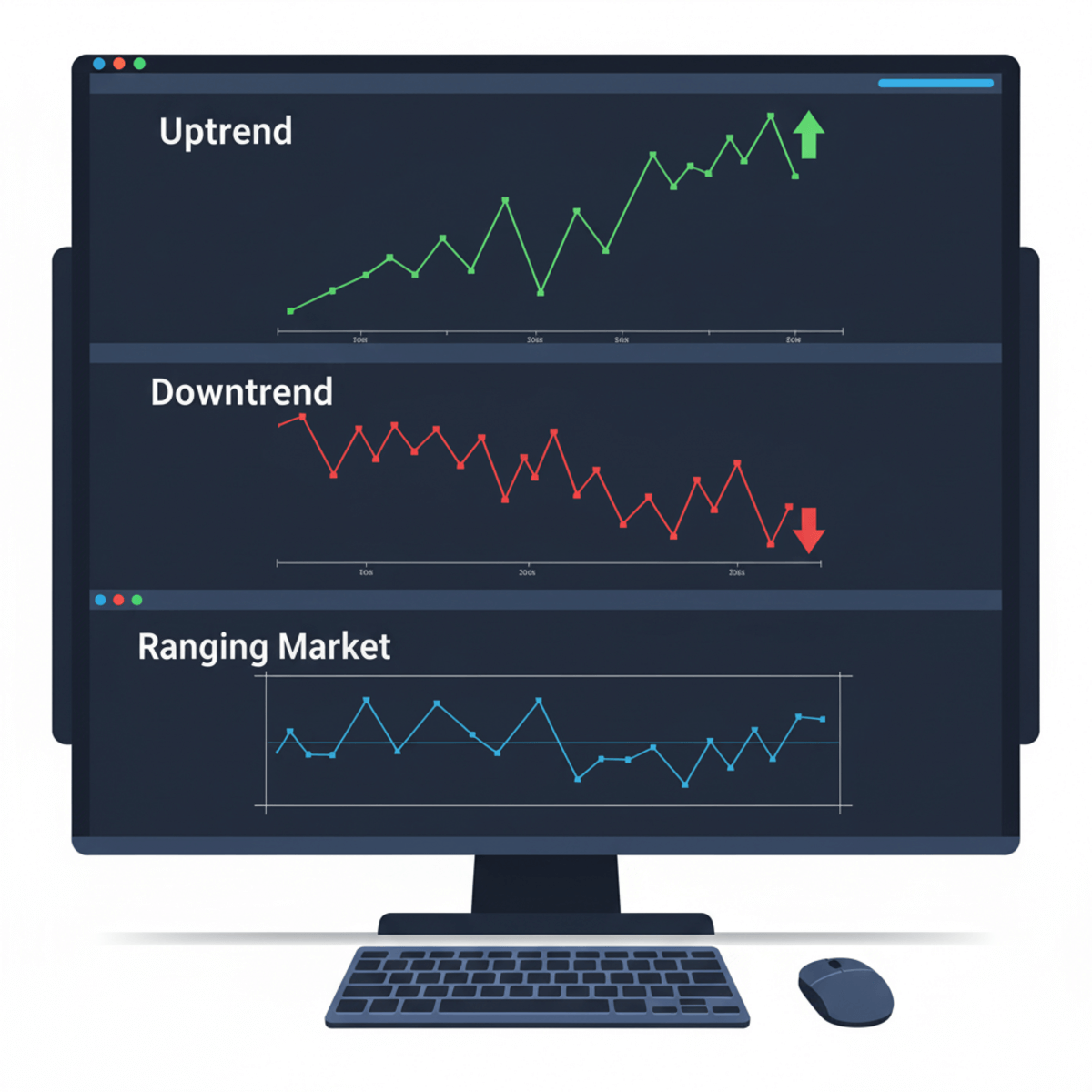

If you want to succeed in trading, you must first understand the market environment you’re trading in. Price doesn’t move randomly—it flows in patterns called trends. Knowing whether the market is in an uptrend, downtrend, or ranging condition helps you choose the right strategy and avoid costly mistakes. In this guide, we’ll break down uptrend, downtrend, and ranging markets, and how you can trade them with confidence.

Learn the Secret of Forex Trading, Click here to download a free e-book now

Key Summary

- Uptrend: Higher highs, higher lows → look for buys.

- Downtrend: Lower highs, lower lows → look for sells.

- Ranging: Price stuck between support and resistance → trade within the box.

Understanding market trends is the foundation of every trading decision.

What is a Market Trend?

A market trend is the general direction of price movement over a period of time.

- If price keeps making higher highs and higher lows, it’s an uptrend.

- If price keeps making lower highs and lower lows, it’s a downtrend.

- If price is bouncing between support and resistance without a clear direction, it’s ranging.

Traders who fail to recognize trends often apply the wrong strategies at the wrong time.

Types of Market Trends

1. Uptrend (Bullish Market)

An uptrend happens when buyers are in control. Price climbs higher, pulling back slightly before continuing upward.

Clues of an uptrend:

- Higher highs and higher lows

- Moving averages pointing upward

- Strong bullish candlesticks at support zones

How to trade it:

- Look for buy opportunities.

- Use pullbacks to support or Fibonacci retracement levels as entry points.

- Ride the trend instead of trying to pick the top.

2. Downtrend (Bearish Market)

A downtrend is when sellers dominate. Price moves lower, with small retracements before continuing downward.

Clues of a downtrend:

- Lower highs and lower lows

- Moving averages sloping downward

- Bearish candles forming at resistance

How to trade it:

- Focus on sell opportunities.

- Enter on pullbacks to resistance or retracement levels.

- Avoid catching falling knives—trade with the flow.

3. Ranging Market (Sideways Movement)

A ranging market occurs when neither buyers nor sellers are in control. Price bounces between horizontal support and resistance.

Clues of a range:

- Price moves within a box or channel

- No clear higher highs or lower lows

- Flat moving averages

How to trade it:

- Buy at support, sell at resistance.

- Use oscillators (RSI, Stochastic) to confirm overbought/oversold zones.

- Avoid breakout entries until the range ends.

Why Market Trends Matter

- Helps you choose the right strategy (trend-following or range trading).

- Reduces unnecessary losses from trading against momentum.

- Improves timing of entries and exits.

- Gives you confidence by aligning with the market’s direction.

Bottom Line

Markets don’t move randomly—they trend. By learning to identify whether the market is in an uptrend, downtrend, or range, you’ll instantly improve your chances of success. The secret is simple: trade with the trend, not against it

FAQ on Market Trends

Q: Which trend is the easiest to trade?

A: Uptrends are generally easier for beginners because markets tend to rise more steadily than they fall.

Q: How long do trends last?

A: Trends can last minutes (scalping), hours (intraday), or even months (swing trading). Always match your strategy to your timeframe.

Q: Can you trade ranges successfully?

A: Yes, but you must be disciplined. Buy near support and sell near resistance, while keeping stops tight.

Q: What indicator is best for spotting trends?

A: Moving averages (like the 50 EMA) are simple and effective for identifying market direction.