Forex trading can feel confusing when you’re just starting. Too many charts. Too many indicators. The truth? You don’t need complex systems to trade well. You need simple forex trading strategies you can understand and follow.

Here are five easy forex trading strategies to help you trade with more confidence

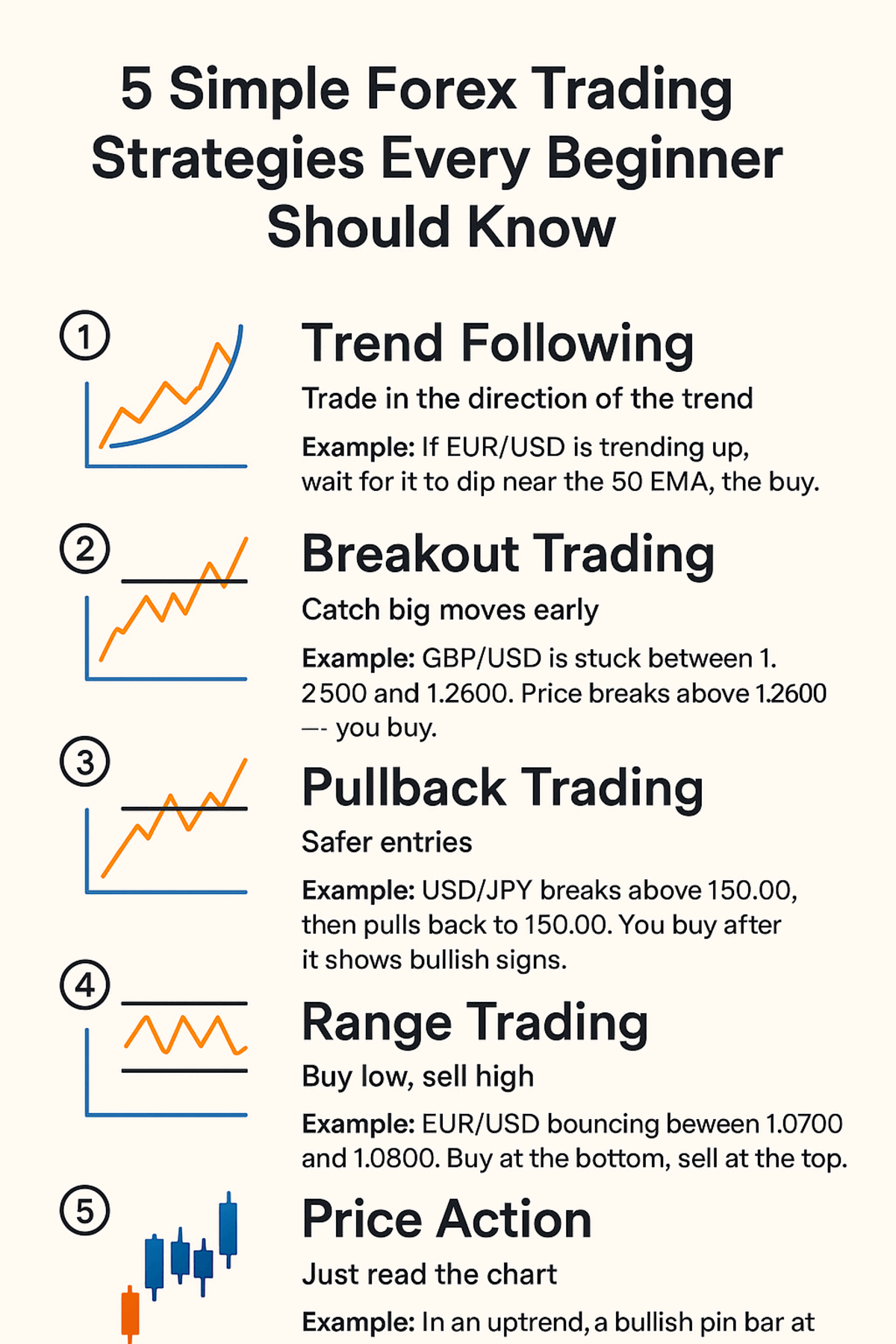

5 Simple Forex Trading Strategies Every Beginner Should Know

Trend Following — Trade With the Market

The trend is your friend.

- Look at the chart. If price is going up (higher highs & higher lows) — buy. If it’s going down — sell.

- Use a simple moving average (like 50 EMA) to see direction.

- Enter after a small pullback so you’re not chasing price.

Example: If EUR/USD is trending up, wait for it to dip near the 50 EMA, then buy.

Breakout Trading — Catch Big Moves

Markets often pause before a strong push.

- Mark support and resistance levels where price keeps bouncing.

- Wait for price to break out with a strong candle.

- Enter in the breakout direction.

Example: GBP/USD is stuck between 1.2500 and 1.2600. Price breaks above 1.2600 — you buy.

Pullback Trading — Safer Entries

Instead of jumping on the breakout, wait for the pullback.

- After a breakout, price often comes back to retest the level.

- Enter when you see rejection candles (like pin bars or engulfing candles).

Example: USD/JPY breaks above 150.00, then pulls back to 150.00. You buy after it shows bullish signs.

Range Trading — Buy Low, Sell High

Sometimes price moves sideways.

- Draw lines where price keeps stopping (support & resistance).

- Buy near support, sell near resistance until it breaks out.

Example: EUR/USD bouncing between 1.0700 and 1.0800. Buy at the bottom, sell at the top.

Price Action — Just Read the Chart

You don’t need fancy indicators. Learn candlestick signals:

- Pin bar = rejection.

- Engulfing candle = strong move.

- Inside bar = market pause before breakout.

Example: In an uptrend, a bullish pin bar at support can mean a buy.

Quick Risk Tip

- Risk only 1–2% per trade.

- Always use stop loss.

- Don’t overtrade. Stick to your plan.

Bottom Line

Keep it simple. Start with one or two forex trading strategies, practice, and stay disciplined. These basic setups can help you trade better without feeling lost.

FAQ

Q: Can I use these on any pair?

Yes, but majors like EUR/USD or GBP/USD are easier for beginners.

Q: Best timeframe?

4-hour and daily charts are less stressful and more reliable.

Q: Do I need paid indicators?

No. Free tools on MT4, MT5, or TradingView are enough.