Every trader, no matter how skilled, will face drawdown. The real question is: how do you manage it without losing your account or your mind? In this article, I’ll share what drawdown is, why it happens, and practical steps on how to manage drawdown in forex.

Key Summary

- Drawdown is normal — every trader faces it.

- Keep risk small (1–2% per trade) to protect your account.

- Stop losses + smaller lots help you recover without stress.

- Don’t overtrade; review your journal and take breaks when needed.

- The goal is not to avoid drawdown completely but to manage it wisely so you stay in the game long enough to succeed.

What is Drawdown in Forex?

In simple terms, drawdown is the percentage your account drops from its peak balance before it recovers.

For example:

- If your account grew to $1,000 and then fell to $800, your drawdown is 20%.

- If it later grows above $1,000, the drawdown is “recovered.”

So, drawdown doesn’t just mean losing trades; it’s about how much your capital goes down before bouncing back.

Why Does Drawdown Happen?

There are many reasons:

- Over-leveraging – risking too much per trade.

- No stop loss – letting losses run.

- Emotional trading – revenge trading or overtrading.

- Market conditions – sideways or unexpected news moves.

Understanding why your drawdown happens is the first step to fixing it.

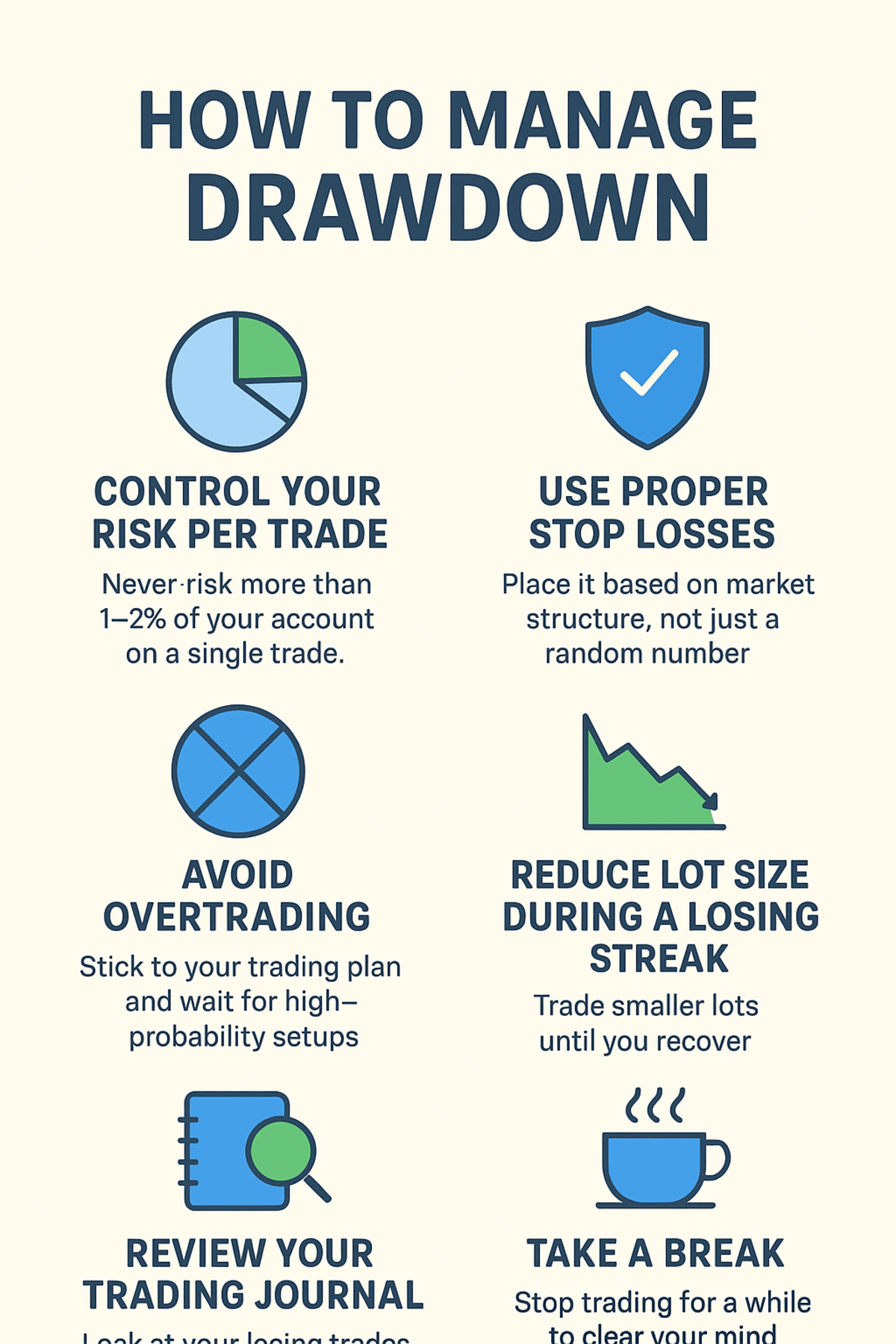

How to Manage Drawdown in Forex Trading

1. Control Your Risk Per Trade

Never risk more than 1–2% of your account on a single trade.

-

Example: On a $1,000 account, don’t risk more than $10–20.

This ensures that even after a losing streak, your account is still alive.

2. Use Proper Stop Losses

A stop loss is your best friend during tough times.

- Place it based on market structure (support/resistance), not just a random number.

- Avoid moving your stop further away when price is against you.

3. Avoid Overtrading

One of my biggest mistakes was thinking I could “win it back” by opening more trades.

- The truth? Overtrading just deepens drawdown.

- Stick to your trading plan and wait for high-probability setups.

4. Reduce Lot Size During a Losing Streak

When you are in drawdown, protect your capital by trading smaller.

-

Example: If you usually trade 0.10 lots, cut it to 0.05 until you recover.

This gives you room to breathe and rebuild slowly.

5. Review Your Trading Journal

Your trading journal is the map that shows where you went wrong.

- Look at your losing trades.

- Was it bad strategy, poor timing, or emotions?

Once you spot the pattern, you can adjust.

6. Take a Break

Sometimes, the best way to manage drawdown is to stop trading for a while. Clear your mind, review your system, and come back stronger.

The Bottom Line

What separates winning traders from the rest is not avoiding losses but knowing how to manage drawdown in forex trading without losing focus or blowing the account. Take it slow, protect your capital, and trust your process. If you stay disciplined and patient, every drawdown becomes just another step toward becoming a consistent trader.

FAQ on Managing Drawdown

1. What is a safe drawdown level in forex trading?

A safe drawdown is usually below 20%. Anything beyond that can put your account at serious risk.

2. Can I recover from a 50% drawdown?

Yes, but it takes discipline and smaller position sizes. A 50% drawdown requires a 100% gain to recover, so it’s better to avoid getting there in the first place.

3. Should I stop trading completely during a drawdown?

If the drawdown is severe, yes—take a break, review your strategy, and only return when you are confident.

4. Does using a stop-loss reduce drawdown?

Yes, a stop-loss is one of the best tools to limit losses and prevent your drawdown from becoming worse.

5. How do professional traders handle drawdowns?

They stick to strict risk management, accept losses as part of trading, and focus on consistency instead of chasing big wins.