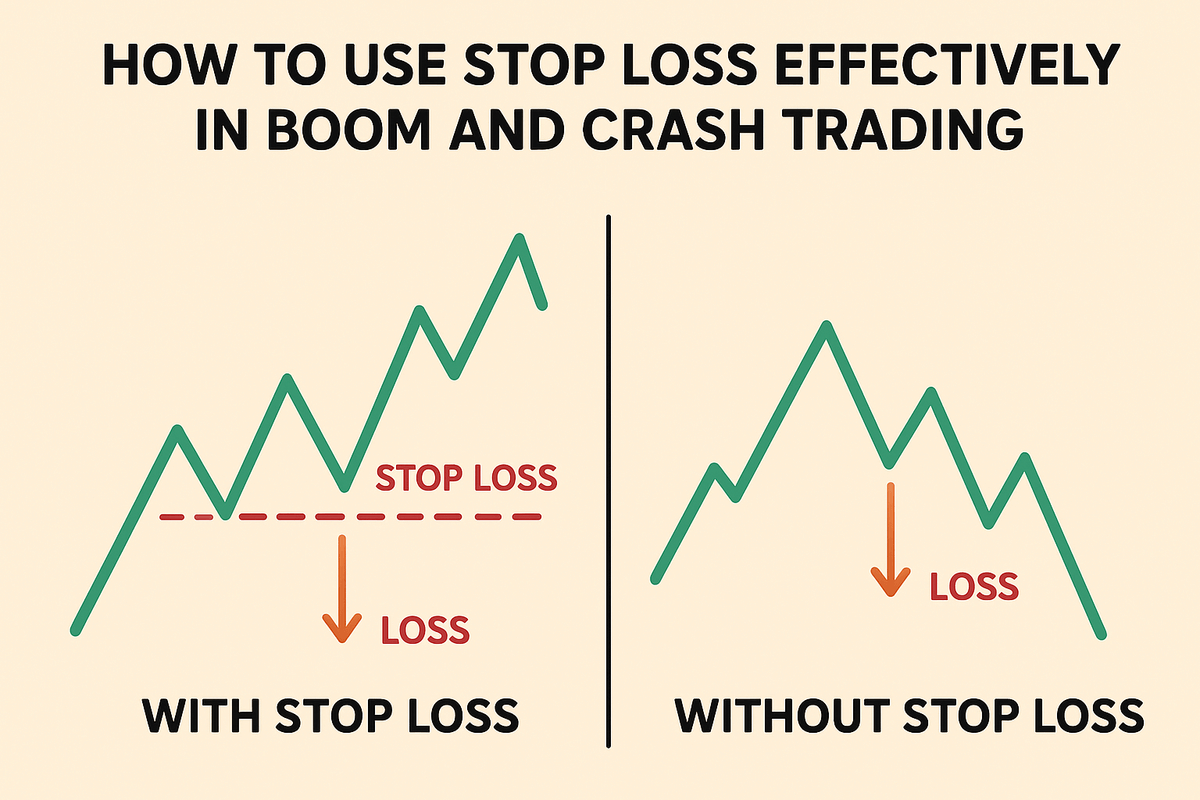

Does stop loss work on Boom and Crash? Of course it does. In this guide, I will explain how to use stop loss effectively in Boom and Crash. From my experience, If you want to succeed in synthetic indices trading, knowing how to use stop loss effectively is very important.

What is Stop Loss?

Stop loss is a limit order you place on the chart to reduce your loss when a trade goes against you. It’s a key part of risk management. Many new traders ignore it, but those who use it wisely always last longer in the market. Think of stop loss as your seat belt. You may not always need it, but when the market spikes against you, it can saves your account.

How Stop Loss Works in Boom and Crash

If you are buying Boom or selling Crash, your stop loss acts as the final line where the broker closes your trade if price goes against your prediction.

If you are selling Boom or buying Crash, your stop loss depends on the length of the spike or crash. That means if a spike extends beyond your SL level, the trade will close at the point where the spike finally ends.

👉 Example:

- If you buy Crash 500 at 5074 with a stop loss at 5024, and a crash happens, your SL will close where the crash finally ends. If the crash extends to 5000, your SL will close at 5000.

- If you sell Crash 500 at 5104 with a take profit at 5074, and the crash extends to 5024, your TP will close at 5024.

That’s why you must place SL carefully when trading Boom and Crash.

Steps to Pick a Good Stop Loss in Boom and Crash

Based on my years of experience, these steps will help you manage SL better:

Step 1: Mark Your Points of Interest (POI)

Before placing trades, identify strong support, resistance, and consolidation zones. These levels often determine where price reacts.

Step 2: Have Clear Conditions for POI

Don’t pick levels randomly. Use a trading plan. For example, if price bounces three times around 5024, that’s a good POI.

Step 3: Place SL and TP Slightly Around Your POI

If you want to buy Crash 500 at 5024, place your SL a few pips below the nearest support. If price breaks that support, your SL saves you from a bigger loss.

👉 Pro Tip: Once a trade goes into profit, move your SL closer to secure profit.

| Feature | Boom Index | Crash Index |

|---|---|---|

| Market Behavior | Sudden upward spikes | Sudden downward crashes |

| Best Direction to Trade | Both, but Buy setups are safer when done at a strong demand zone | Both, but sell setups are safer when done at a strong Supply zone |

| Stop Loss | Spike can extend beyond SL | Crash can extend beyond SL |

| Common Strategy | Buy Boom at Demand zone or at a strong support zone | Sell crash at supply zone or at a strong resistance |

| Main Trading Risk | Spike risk against short positions | Crash risk against long positions |

FAQ on Stop Loss in Boom and Crash

Q1: Does stop loss really work in Boom and Crash?

Yes, but remember spikes and crashes can extend. SL closes where the move ends, not always at your exact level.

Q2: Where should I place my SL when buying Crash or selling Boom?

Place it slightly below (for Crash) or above (for Boom) your marked support/resistance or POI.

Q3: Can I trade Boom and Crash without SL?

Yes, but it’s very risky. One big spike or crash can wipe your account. Always protect your capital.

Q4: How do I avoid being stopped out too early?

Use wider SL based on volatility, and reduce your lot size to manage risk.

Q5: Which is more profitable, Boom or Crash?

Both can be profitable. Crash is usually easier to buy, while Boom is easier to sell. It depends on your analysis and discipline.