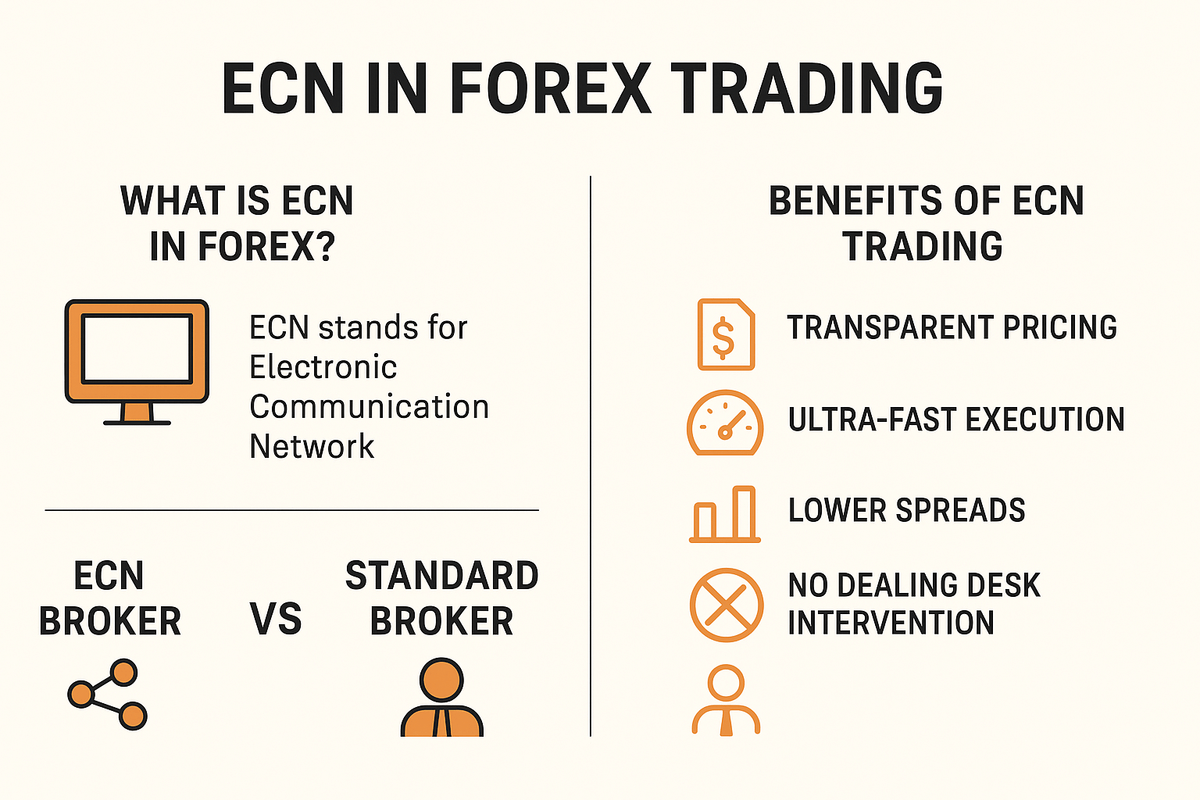

If you’ve been around the forex world for a while, you’ve probably heard the term ECN in forex trading being mentioned by experienced traders. Many say, “Trade with an ECN broker if you want better execution and lower costs.” But what does that really mean? And why do serious traders prefer ECN trading over other broker models? ECN stands for Electronic Communication Network — a system that connects traders directly with liquidity providers (banks, hedge funds, other traders). Many experienced traders prefer ECN trading because it’s transparent, has lower spreads, and gives better execution speed.

Learn the Secret of Forex Trading, Click here to download a free e-book now

What is ECN in Forex Trading?

Electronic Communication Network (ECN) is a technology that matches buy and sell orders in real-time across a pool of liquidity providers. Instead of trading against your broker, you trade through your broker to the real market.

Here’s how it works:

- Your broker sends your order directly to the ECN network.

- The system matches it with the best available buy or sell price.

- No dealing desk — the broker doesn’t manipulate your price.

That’s why ECN brokers are also called “No Dealing Desk” (NDD) brokers.

Why Traders Prefer ECN Trading

True Market Pricing

ECN brokers pull prices from multiple banks and liquidity providers. You see the real market spread, often tighter than traditional brokers.

Example:

Instead of paying a fixed spread of 2 pips on EUR/USD, an ECN broker may show 0.1–0.3 pips plus a small commission.

Faster Execution

Orders go directly to the market with minimal delay — crucial for scalpers and news traders who need lightning-fast fills.

Transparency & No Price Manipulation

Because the broker isn’t taking the other side of your trade, there’s no conflict of interest. ECN brokers earn from small commissions, not your losses.

Better for Large Traders

ECN platforms handle large volume trades better because there’s direct access to deep liquidity.

Ideal for Prop Firm Challenges

If you’re aiming to pass prop firm evaluations (like FTMO), ECN-style trading gives you tighter spreads and less slippage, helping you stay within strict drawdown limits.

ECN vs Standard Brokers

| Feature | ECN Broker | Standard (Market Maker) Broker |

|---|---|---|

| Pricing | Raw spreads + commission | Wider fixed spreads |

| Execution | Direct market access | Internal dealing desk |

| Transparency | High | Lower |

| Slippage | Lower | Higher during volatility |

| Best For | Experienced & serious traders | Beginners & casual traders |

Tips When Choosing an ECN Broker

- Check regulation & reputation

- Look for low commissions and competitive spreads

- Ensure fast execution speed (low latency servers)

- Test with a demo account before going live

- If trading prop firms like FTMO, check that your ECN broker meets their execution standards

Bottom Line

ECN in forex trading gives you direct access to market liquidity, faster execution, and transparent pricing — no middleman games. If you’re serious about trading or preparing for prop firm challenges, an ECN broker is often the smarter choice.

FAQ — ECN Forex Trading

Q1: Is ECN better than Standard broker (STP)?

Both are good, but ECN usually offers deeper liquidity and tighter spreads. STP is simpler but may have slightly wider spreads.

Q2: Do ECN brokers charge commission?

Yes. They typically charge a small commission per trade instead of marking up spreads.

Q3: Can beginners use ECN brokers?

Yes, but beginners might find commission-based pricing confusing at first.

Q4: Is ECN good for FTMO and prop firm trading?

Absolutely. Tighter spreads and fast execution help you stay within strict rules and reduce slippage.