If you’ve ever placed a trade and realized it opened at a different price than the one you clicked, you’ve experienced slippage. For many new traders, it feels unfair or even like a “broker trick,” but the truth is slippage is a normal part of forex trading. In this article, I’ll break down what slippage in forex is, why it happens, the difference between positive and negative slippage, and practical ways you can avoid it. I’ll also share my personal story of how slippage cost me a profitable setup during NFP week.

Key Summary

- Slippage in forex happens when your trade executes at a different price than expected.

- It can be positive (better price) or negative (worse price).

- Slippage is common during high volatility news events or low liquidity periods.

- Using the right broker, trade times, and order types can reduce slippage.

What is Slippage in Forex?

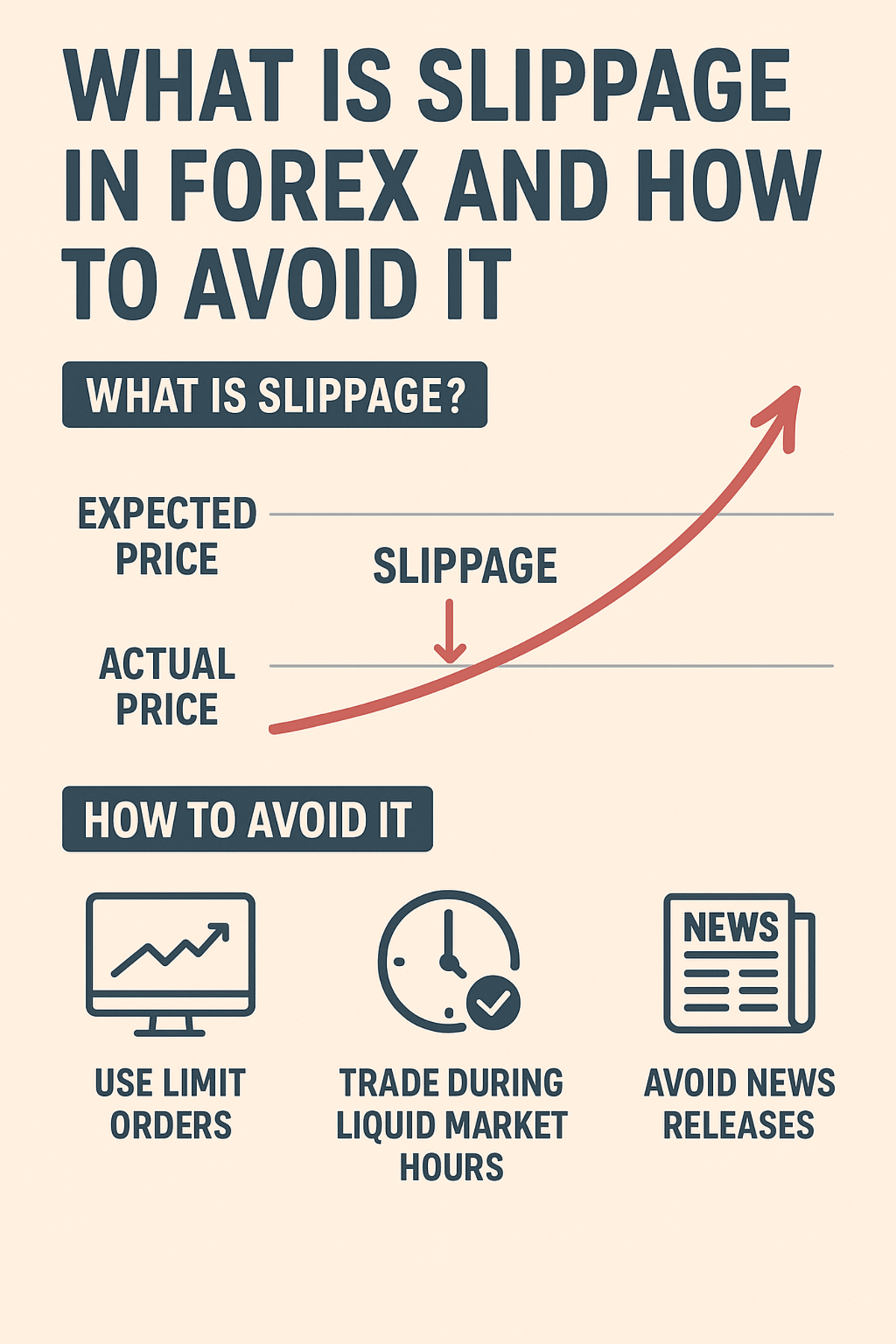

In forex trading, slippage is the difference between the expected price of a trade and the actual price at which it is executed.

Example: You place a buy order for EUR/USD at 1.1000. By the time the broker processes your order, the price moves to 1.1003. That 3-pip difference is slippage.

It happens because the forex market moves so quickly that prices change in milliseconds.

| Type | Meaning | Impact on Trader |

|---|---|---|

| Positive Slippage | Your order executes at a better price than requested | Increases your profit potential |

| Negative Slippage | Your order executes at a worse price than requested. | Reduces profit or increases loss. |

Yes — slippage can actually work in your favor. But most traders only notice the negative side.

Why Does Slippage Happen in Forex?

Several factors contribute to slippage:

- Market Volatility – Big news events (like NFP, interest rate announcements) move prices too fast for instant execution.

- Low Liquidity – Exotic pairs or off-peak sessions have fewer buyers/sellers, causing order delays.

- Order Size – Large positions take longer to fill, making them more prone to slippage.

- Broker Execution Speed – Market makers may delay execution slightly compared to ECN/STP brokers

How to Avoid Slippage in Forex

You can’t eliminate slippage completely, but you can minimize it:

- Trade during high liquidity sessions – London and New York overlaps usually have smoother execution.

- Avoid major news releases unless you are an experienced news trader.

- Use limit orders instead of market orders – they give you more control over entry price.

- Choose a fast ECN/STP broker – execution speed matters.

- Stick to major pairs (EUR/USD, GBP/USD, USD/JPY) with tighter spreads and higher liquidity.

- Check your internet speed – a lagging connection can worsen slippage.

Slippage vs. Requotes: Are They the Same?

Many traders confuse slippage with requotes. Here’s the difference

| Feature | Slippage | Requote |

|---|---|---|

| What Happens | Order is filled at a different price than requested | Broker rejects your order and asks if you want to accept a new price. |

| Cause | Fast-moving market or liquidity issues | Broker’s dealing desk intervention |

| Trader Control | No choice — trade executes instantly. | You can accept or reject the new price |

FAQ on Forex Slippage

Q1: Is slippage always bad?

No. Sometimes slippage can be positive, meaning your trade opens at a better price than expected.

Q2: Which forex pairs have the least slippage?

Major pairs like EUR/USD and USD/JPY usually have the least slippage due to high liquidity.

Q3: How much slippage is normal in forex?

It depends on market conditions, but 1–3 pips is common during normal sessions. During news events, slippage can jump 10+ pips.

Q4: Does every broker have slippage?

Yes, slippage is a market phenomenon, not just a broker issue. But ECN/STP brokers generally handle it better.

Q5: Can stop-loss orders experience slippage?

Yes. In highly volatile markets, your stop-loss may be filled at a worse level than expected.

Final Thoughts

So, what is slippage in forex and how to avoid it? It’s simply the difference between your intended price and your actual execution price. While you can’t escape slippage entirely, you can reduce it by trading during high liquidity, avoiding news spikes, using limit orders, and choosing the right broker.

Slippage is part of the forex game — learn to respect it, plan for it, and it won’t catch you off guard.