One of the easiest ways to trade forex — and still one of the most powerful — is trend following. Instead of fighting the market, you simply trade in the direction it’s already going.

Learn the Secret of Forex Trading, Click here to download a free e-book now

You don’t need complicated indicators or advanced patterns. You just need to know how to spot a trend, wait for a good entry, and manage your risk. This guide will show you how.

What is Trend Following?

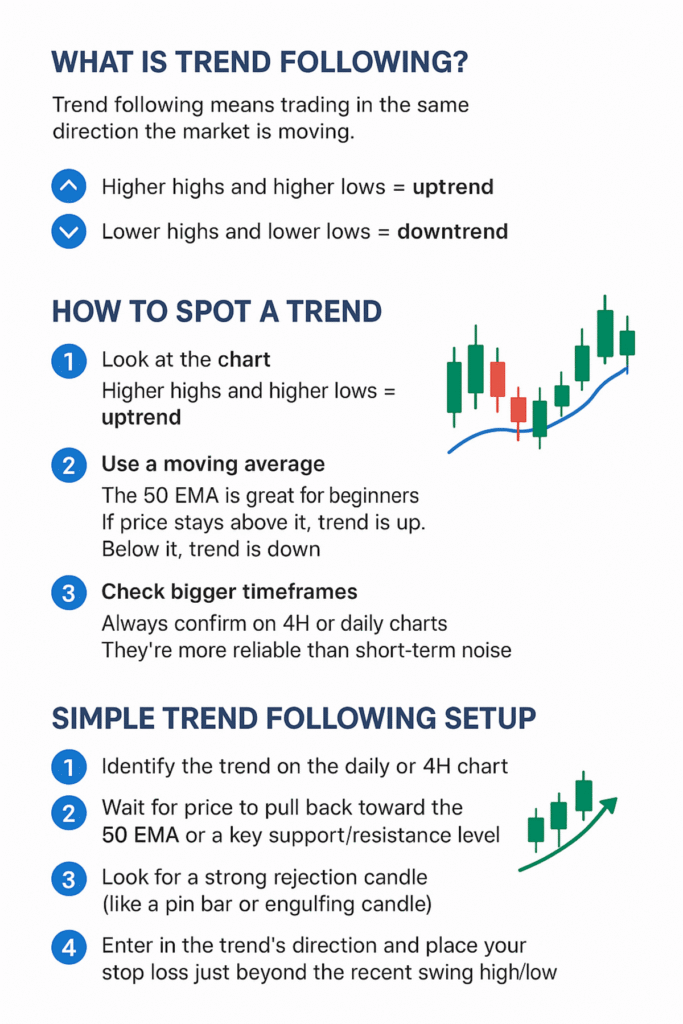

Trend following means trading in the same direction the market is moving.

- If price is going up and making higher highs and higher lows, it’s an uptrend.

- If price is going down with lower highs and lower lows, it’s a downtrend.

Your job? Join that direction and ride the move for as long as it lasts.

How to Spot a Trend

-

Look at the chart — Higher highs and higher lows = uptrend. Lower highs and lower lows = downtrend.

-

Use a moving average — The 50 EMA is great for beginners. If price stays above it, trend is up. Below it, trend is down.

-

Check bigger timeframes — Always confirm on 4H or daily charts. They’re more reliable than short-term noise.

Simple Trend Following Setup

Here’s a simple plan to follow trends:

- Identify the trend on the daily or 4H chart.

- Wait for price to pull back toward the 50 EMA or a key support/resistance level.

- Look for a strong rejection candle (like a pin bar or engulfing candle).

- Enter in the trend’s direction and place your stop loss just beyond the recent swing high/low.

Example: EUR/USD is trending up. Price dips to the 50 EMA, forms a bullish pin bar, you buy and ride the next wave.

Risk Management Tips

Even the best trend setups can fail. Protect yourself:

- Risk 1–2% of your account per trade.

- Place stop loss where the trend would be invalidated.

- Don’t move your stop too early — let the trend breathe.

- Take partial profits at key levels.

Common Mistakes to Avoid

- Chasing the trend late: Wait for pullbacks; don’t enter after huge moves.

- Ignoring bigger timeframes: Always confirm the main trend before jumping in.

- Overleveraging: Big trends can reverse — trade small and safe.

FAQ

Q: Can I use trend following on any pair?

Yes, but major pairs like EUR/USD, GBP/USD, and USD/JPY are more stable.

Q: What’s the best timeframe?

4H and daily charts work best for spotting strong trends.

Q: Do I need expensive indicators?

No. Price action and a simple moving average are enough.

Bottom Line

Trend following is one of the simplest and most reliable ways to trade forex. Stop overthinking. Watch where the market is going, wait for a clean entry, and manage your risk.