Candlestick charts are one of the most effective ways to read the forex market. Every candle tells a story of how buyers and sellers fought during that time. As a trader with over 10 years of experience, I can confidently say that mastering candlestick patterns is one of the fastest ways to improve your trading decisions.

Key Summary

- Candlestick patterns reveal market psychology between buyers and sellers.

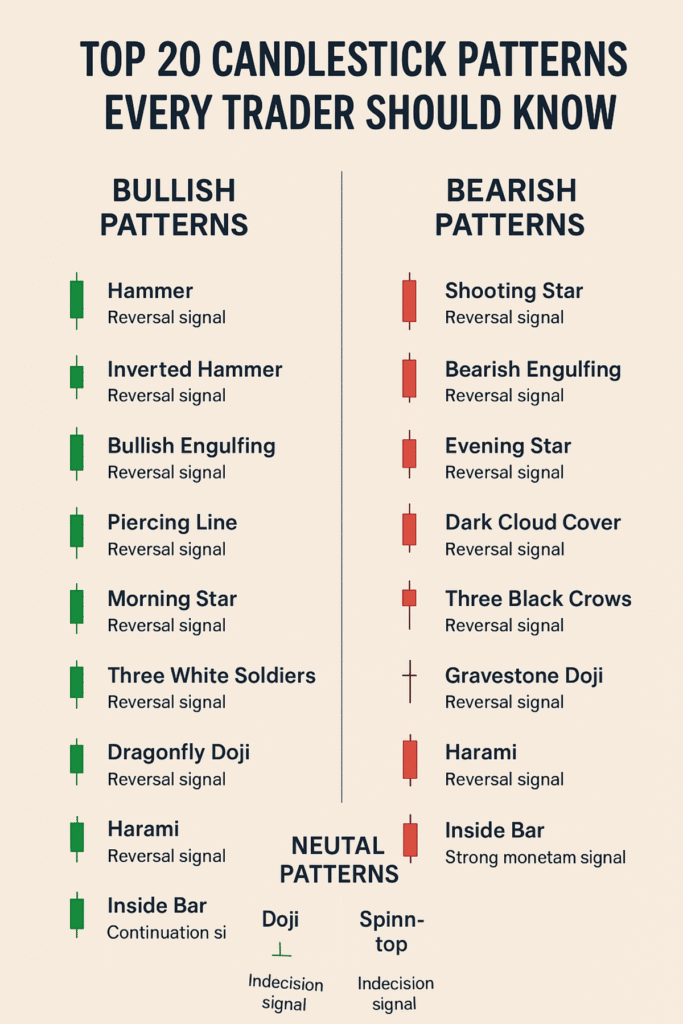

- The Top 20 candlestick patterns include bullish, bearish, and neutral formations.

- Each pattern gives clues on reversals, continuations, or indecision.

- When combined with support, resistance, and market structure, candlesticks become powerful trading tools.

In this guide, we will cover the Top 20 Candlestick Patterns, what they represent, when to expect them, and how to trade them.

Top 20 Candlestick Patterns and How to Trade Them

1. Hammer

- When to expect: At the bottom of a downtrend.

- Represents: Buyers are stepping in after sellers pushed price down.

- How to trade: Look for confirmation candle closing bullish.

2. Inverted Hammer

- When to expect: At the bottom of a downtrend.

- Represents: Sellers tried to push down but failed.

- How to trade: Wait for bullish confirmation.

3. Bullish Engulfing

- When to expect: During a downtrend.

- Represents: Buyers completely took control.

- How to trade: Enter long after engulfing candle closes.

4. Piercing Line

- When to expect: At the end of a downtrend.

- Represents: Buyers reversing the trend.

- How to trade: Buy after confirmation.

5. Morning Star

- When to expect: At the end of a downtrend.

- Represents: Strong bullish reversal.

- How to trade: Enter buy after the third candle closes.

6. Three White Soldiers

- When to expect: After consolidation or downtrend.

- Represents: Continuous bullish momentum.

- How to trade: Look for entries with support levels.

7. Shooting Star

- When to expect: At the top of an uptrend.

- Represents: Buyers exhausted, sellers taking over.

- How to trade: Sell after confirmation candle.

8. Bearish Engulfing

- When to expect: At the top of an uptrend.

- Represents: Strong seller dominance.

- How to trade: Sell after engulfing candle closes.

9. Evening Star

- When to expect: At the top of an uptrend.

- Represents: Bearish reversal.

- How to trade: Enter sell after third candle.

10. Dark Cloud Cover

- When to expect: At the end of an uptrend.

- Represents: Sellers stepping in strongly.

- How to trade: Confirm with next bearish candle.

11. Three Black Crows

- When to expect: After an uptrend.

- Represents: Continuous selling pressure.

- How to trade: Enter sell with market structure confirmation.

12. Doji

- When to expect: At tops, bottoms, or consolidation.

- Represents: Indecision between buyers and sellers.

- How to trade: Wait for breakout direction.

13. Dragonfly Doji

- When to expect: At the bottom of a downtrend.

- Represents: Strong rejection of lower prices.

- How to trade: Look for bullish confirmation.

14. Gravestone Doji

- When to expect: At the top of an uptrend.

- Represents: Strong rejection of higher prices.

- How to trade: Sell after bearish confirmation.

15. Spinning Top

- When to expect: During consolidation.

- Represents: Market indecision.

- How to trade: Wait for next candle to give direction.

16. Marubozu

- When to expect: In strong trends.

- Represents: Full control by buyers (bullish) or sellers (bearish).

- How to trade: Trade in the direction of Marubozu.

17. Tweezer Top

When to expect: At the top of an uptrend.

Represents: Reversal signal.

How to trade: Confirm with bearish candle.

18. Tweezer Bottom

- When to expect: At the bottom of a downtrend.

- Represents: Buyers taking control.

- How to trade: Confirm with bullish candle.

19. Harami (Bullish or Bearish)

- When to expect: During reversal zones.

- Represents: Weakening momentum.

- How to trade: Enter trade after breakout.

20. Inside Bar

- When to expect: During consolidation.

- Represents: Market preparing for breakout.

- How to trade: Trade in direction of breakout.

Bottom Line

Candlestick patterns are powerful tools for reading the psychology of the market. By mastering these Top 20 candlestick patterns, traders can quickly identify reversals, continuations, and indecision points.

FAQs on Candlestick Patterns

Q1: Which candlestick pattern is the most reliable?

A: The Engulfing patterns and Morning/Evening Stars are among the most reliable when confirmed with support/resistance.

Q2: Can candlestick patterns work alone?

A: No. Always combine them with market structure, trend, and support/resistance.

Q3: Do candlestick patterns work in all timeframes?

A: Yes, but higher timeframes (H1, H4, Daily) are more reliable than M1 or M5.

Q4: Can candlestick patterns be used in synthetic indices or crypto?

A: Yes. Price action works across all markets.