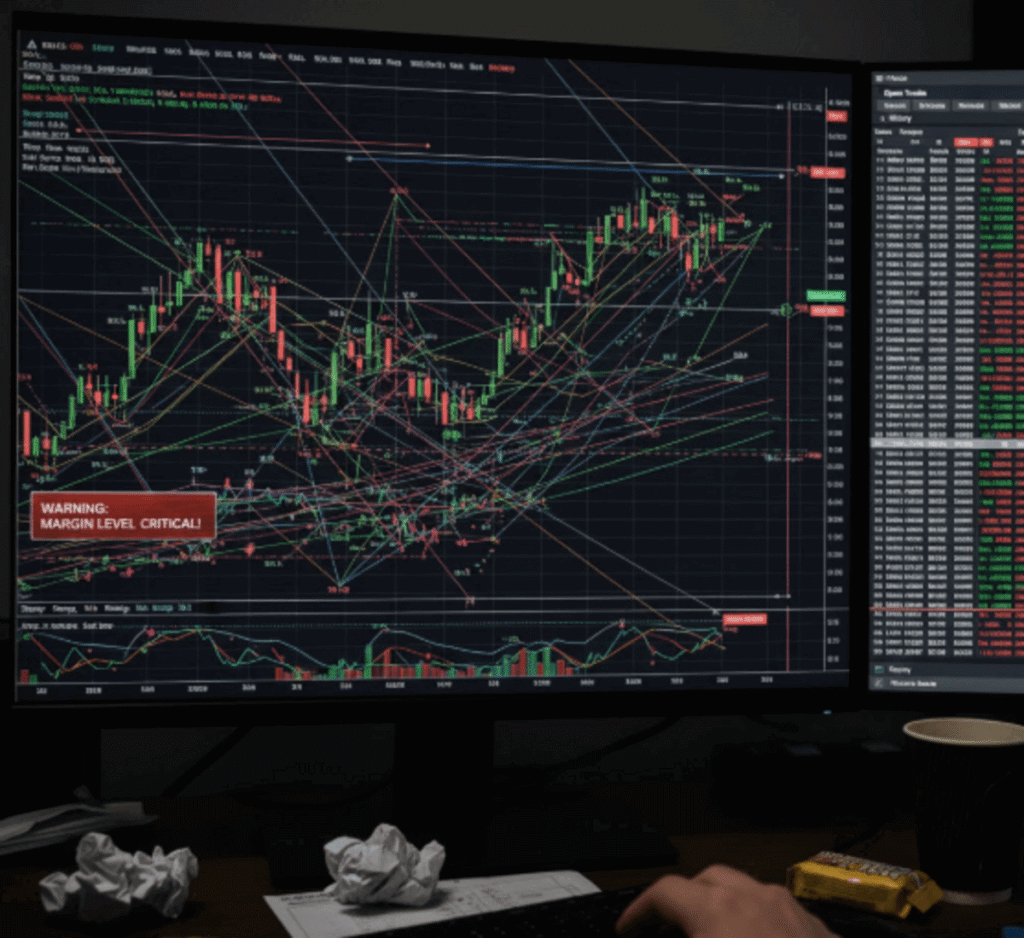

If you’ve ever found yourself staring at the charts, taking trade after trade — hoping the next one will finally “make up” for the last loss — you’re not alone.

Overtrading in forex is one of the most common and silent killers in forex. It doesn’t just drain your trading account; it slowly eats away at your confidence, patience, and discipline — the three things you need to win.

Over the years, I’ve seen brilliant traders with solid strategies fail, not because they didn’t understand the market, but because they couldn’t stop clicking that buy or sell button.

Let’s break it down — what overtrading really is, why it happens, and how to stop it before it wrecks your trading career.

What Is Overtrading in Forex?

Overtrading simply means taking too many trades in a short period, often based on emotions rather than strategy.

It usually happens when a trader:

- Enters multiple positions without valid setups.

- Trades every price movement out of boredom or fear of missing out.

- Increases lot sizes after losses, hoping to recover quickly.

Overtrading gives you the illusion of activity — you feel productive, but in reality, you’re just digging a deeper hole.

According to data from broker analytics, around 70% of losing traders admit to trading more than their plan allows, especially after losing trades. It’s not about knowledge — it’s about control.

The Hidden Costs of Overtrading

1. Financial Damage

Let’s start with the obvious.

When you overtrade, your transaction costs — spreads, commissions, and slippage — pile up fast.

Even if you’re right 50% of the time, the extra costs will quietly drain your profits.

A trader risking $10 per trade who takes 20 unnecessary trades a week could easily lose $200–$300 monthly — not from bad strategy, but from too many trades.

2. Emotional Burnout

Every trade comes with an emotional load — anxiety, hope, fear, excitement.

Overtrading means your emotions are constantly active.

You start making decisions from fatigue rather than logic. That’s when revenge trading and impulsive entries sneak in.

Soon, the market starts controlling you instead of the other way around.

3. Loss of Objectivity

The more trades you take, the harder it becomes to analyze them properly.

You no longer see price action clearly; you only see opportunities to jump in.

Overtraders tend to ignore their rules, skip confirmations, and force setups that aren’t there.

4. Account Wipeouts

Many blown accounts didn’t die from one bad trade — they died from too many average ones.

It’s death by a thousand cuts.

Each small loss feels manageable until the cumulative effect wipes out weeks or months of effort.

Why Traders Overtrade

Understanding why you overtrade is half the battle.

Here are the main psychological triggers:

1. Fear of Missing Out (FOMO)

You see a big move and think, “If I don’t enter now, I’ll miss it.”

So, you jump in — usually at the worst possible time — and get stopped out.

The truth: the market will always create another opportunity. Always.

2. Revenge Trading

After a loss, the natural urge is to win it back quickly.

So, you rush into another trade without analysis.

This emotion-fueled pattern is one of the biggest reasons accounts vanish.

3. Boredom

Sometimes, the market is quiet. But traders hate waiting.

They take random trades just to feel “in the game.”

Professional traders understand that doing nothing is also a trading decision.

4. Lack of a Clear Plan

If you don’t have specific rules about when to enter, how many trades to take, and what to avoid, you’ll trade based on emotion instead of evidence.

How to Stop Overtrading in Forex

1. Set a Daily or Weekly Trade Limit

Before the week begins, decide how many trades you’ll allow yourself — and stick to it.

Example: “I’ll only take 3 high-probability setups this week.”

This forces you to be selective and disciplined.

2. Journal Every Trade

After each trade, note why you took it, your emotional state, and the result.

Within two weeks, you’ll start seeing patterns in your behavior.

You’ll quickly realize how many trades you’re taking out of boredom or frustration.

3. Use Higher Timeframes

Scalpers are more likely to overtrade because they see setups every few minutes.

Shifting to higher timeframes (like H4 or Daily) naturally slows your trading pace and improves decision-making.

4. Reward Discipline, Not Just Profit

After a disciplined week (even if you broke even), reward yourself.

This rewires your brain to value process over outcome.

5. Use an Alert System Instead of Watching Charts All Day

Set price alerts for your key levels.

This keeps you from staring at the screen and being tempted to enter random trades.

6. Stick to One or Two Trading Setups

The more strategies you use, the more opportunities you see — and the more you’ll trade.

Simplify your system. Master one strategy and ignore everything else.

Overtrading isn’t about lack of skill — it’s about lack of patience.

The forex market will reward those who wait and punish those who chase.

Professional traders trade less but better.

They understand that trading is a marathon, not a sprint.

You don’t have to be in a trade to make money — sometimes, the best position is no position.

Bottom Line

Overtrading in forex is a hidden enemy that eats your account slowly.

If you feel like you’re always in the market, always watching charts, and always chasing setups — pause. Step back. Review.

Trading is not about taking every trade.

It’s about taking the right ones.