One of the most common reasons traders blow their accounts is poor risk management. Many traders focus on signals, indicators, or win rates, but the truth is simple: if your risk-to-reward strategy is weak, you will eventually blow your account.

Learn the Secret of Forex Trading, Click here to download a free e-book now

The Risk-to-Reward Strategy ensures that every trade you take has the potential to make you more than what you risk. This method works with scalping, day trading, or swing trading. When applied correctly, it will protect your capital, reduce stress, and put you in the mindset of a professional trade

Key Summary

- The Risk-to-Reward Strategy is the backbone of long-term forex trading success.

- By setting a minimum 1:2 or 1:3 ratio, traders protect their accounts from rapid losses.

- The strategy allows traders to win less often but still remain profitable.

- Proper implementation requires discipline, patience, and consistent risk management.

The truth is, most traders don’t lose money because they can’t pick a direction. They lose because they risk too much for too little. That’s why learning the risk-to-reward strategy is the difference between blowing accounts and growing accounts.

What is Risk-to-Reward Ratio?

The Risk-to-Reward Ratio compares the amount of money you are willing to risk on a trade to the amount you expect to gain.

In simple words:

- Risk = potential loss if the trade goes wrong.

- Reward = potential profit if the trade goes right.

For example, if you risk $10 to make $30, your risk-to-reward ratio is 1:3.

Why Risk-to-Reward Matters in Forex

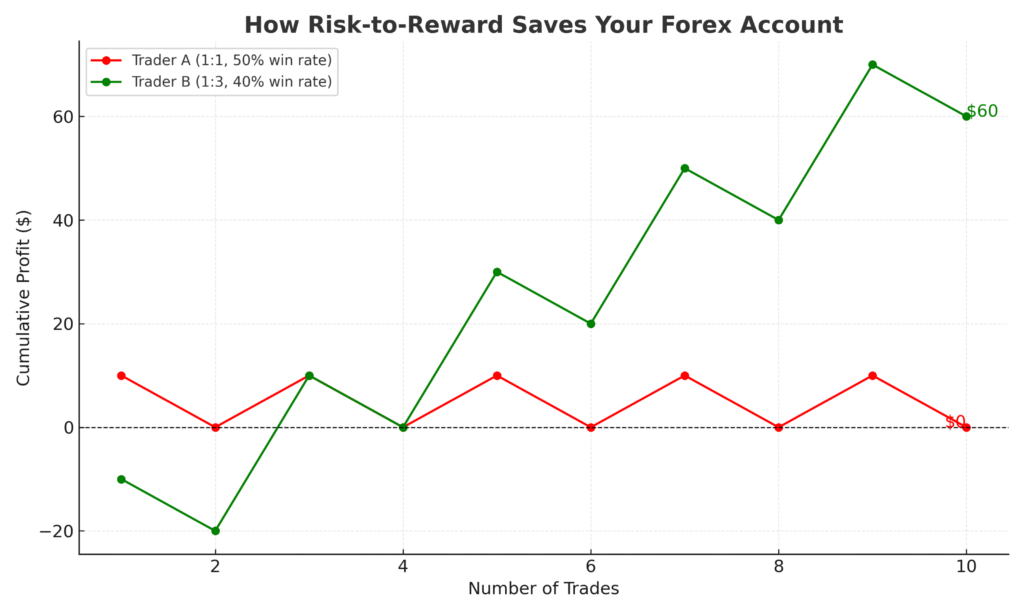

A trader with a 40% win rate but a 1:3 risk-to-reward ratio can still grow his account. On the other hand, a trader with 70% win rate but a 1:1 ratio can still blow his account if emotions take over.

It’s not how often you win, it’s how much you win compared to what you risk.

Example of Risk-to-Reward in Action

Let’s take XAU/USD (Gold) as an example:

- Account size: $500

- Risk per trade: 2% ($10)

- Stop Loss: 20 pips ($10)

- Take Profit: 60 pips ($30)

- Risk-to-Reward Ratio: 1:3

If you lose 5 trades in a row = -$50.

If you win just 2 trades after that = +$60.

Net result = +$10 (still profitable despite losing more).

This is the power of the Risk-to-Reward Strategy.

| Trade Setup | Risk (Stop Loss) | Reward (Take Profit) | Risk-to-Reward Ratio |

|---|---|---|---|

| Buy EUR/USD | 20 pips = $20 | 40 pips = $40 | 1:2 |

| Buy XAU/USD | 50 pips = $25 | 150 pips = $75 | 1:3 |

| Sell GBP/JPY | 30 pips = $15 | 90 pips = $45 | 1:3 |

Even if you lose 2 trades and win 1, you still end up profitable with a good RRR

How the Risk-to-Reward Strategy Stops Account Blowouts

1. Define Your Risk Per Trade

- Never risk more than 2% of your account per trade.

- If you have $100, risk only $2.

- If you have $1,000, risk $20.

This way, even if you lose 10 trades in a row, you’ll still be in the game.

2. Set Your Stop Loss First

- Forget the profit for a moment. Decide on the stop loss

- If you buy at support, your stop loss should be just below support.

- If you sell at resistance, your stop should be just above it.

- If the market setup doesn’t allow for proper RRR, skip the trade

3. Target at Least 1:2 or 1:3

Once you set your stop loss, multiply it by 2 or 3 to find your take profit.

Example:

- Stop loss = 20 pips

- Target = 40 pips (1:2) or 60 pips (1:3)

4. Stick to the Plan

Don’t move your stop loss because you “feel” the market will come back. Don’t close early unless your system tells you to. Discipline makes this strategy work.

Bottom Line

The Risk-to-Reward Strategy is not just a tool—it is a survival plan for every forex trader. By applying at least 1:2 or 1:3 ratios, you protect your account, reduce stress, and create a system where losing more trades than you win can still make you profitable.

On MyForexPips, we believe strategies should be simple, practical, and powerful. If you want to stop blowing accounts, start making risk-to-reward your number one rule in trading.

FAQs on Risk-to-Reward Strategy

Q1: What is the best risk-to-reward ratio in forex?

A: The sweet spot is 1:2 or 1:3. Anything less than 1:2 means you are working too hard for too little.

Q2: Can I use risk-to-reward with scalping?

A: Yes. Even if you’re taking 10–20 pip scalps, keep your stop loss small so reward is at least 2x.

Q3: Do professional traders always win more than they lose?

A: Not at all. Some pros win less than 50% of trades but stay profitable because of strong RRR.

Q4: How do I stay disciplined with RRR?

A: Write down your trading plan, use alerts, and never move your stop loss once trade is active.