When I started trading, I used to chase hundreds of pips every day. Most times, I ended up overtrading and blowing my account. But as I grew in trading, I discovered something that changed my approach forever: you don’t need 100 pips a day to succeed. You only need 20 Pips a Day.

That’s how the Strategy was born — a simple, price-action-based method we developed here at MyForexPips to help traders grow small accounts with consistency and confidence.

What is the 20 Pips a Day Strategy?

The Strategy is built on three principles:

- Trade Pure Price Action – no fancy indicators, just support and resistance zones, trendlines, and candlestick patterns.

- Take Only 20 Pips – grab a small, clean move from the market instead of chasing big swings.

- Compound Slowly – small profits add up when you scale correctly.

Whether you’re trading XAU/USD (Gold), EUR/USD, or GBP/USD, the method is the same: spot the setup, confirm the entry, take your 20 pips, and walk away.

Why 20 Pips?

On Gold (XAU/USD), price can move 100–300 pips in one session. Capturing 20 pips is like picking just one fruit from a tree full of ripe fruits.

- It’s low stress – you’re not glued to charts all day.

- It’s achievable daily – even in choppy markets.

- It’s scalable – from $1 a day on a small account to $500+ a day on a big account.

How the 20 Pips a Day Strategy Works (Step by Step)

Here’s the exact process we use at MyForexPips:

1. Mark Support and Resistance

- Go to the 15-minute or 1-hour chart of XAU/USD.

- Identify strong support zones (where price bounced before) and resistance zones (where price rejected before).

2. Wait for Confirmation

Patience is everything. Don’t just jump in. Wait for:

- Rejection Candles (pin bar, engulfing, or strong wicks) at support/resistance.

- Break and Retest (price breaks a level and comes back to test it).

Only trade when the market confirms your zone.

3. Enter with Precision

- If you see a bullish signal at support → Buy.

- If you see a bearish signal at resistance → Sell.

- Place your stop loss just 10–15 pips away, behind the zone, and your TP at 20pips

4. Take 20 Pips and Leave

- The moment price moves +20 pips in your favor, close your trade.

- Don’t get greedy. The rule is simple: Take 20 and log out.

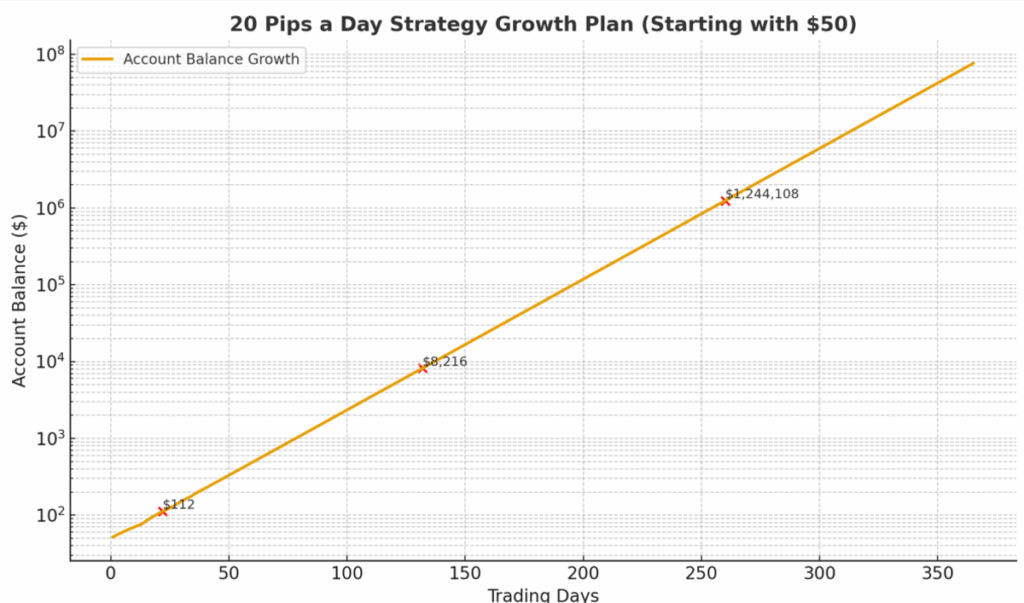

The Growth Plan

Here’s how a trader starting with $50 can grow using the 20 Pips a Day Strategy on Gold:

- Download the Strategy Growth pan by myforexpips here

With patience, consistency, and scaling, a small account can grow to $100,000 over time. It won’t happen overnight, but it will happen if you follow the rules.

Rules You Must Never Break

- Never chase the market. Wait for confirmation.

- Stop after 20 pips.

- Don’t overtrade.

- Use a stop loss – protect your account at all times.

- Journal your trades – learn from wins and losses.

Final Thoughts

This strategy is not magic. It’s not a get-rich-quick trick. It’s a method built on discipline, patience, and pure price action. 20 pips may look small, but when you stick with it, you’ll be amazed at how fast your trading account can grow.

So, the next time you open your chart, don’t chase 100 pips. Focus 20, grab it, and walk away. That’s how smart traders win.