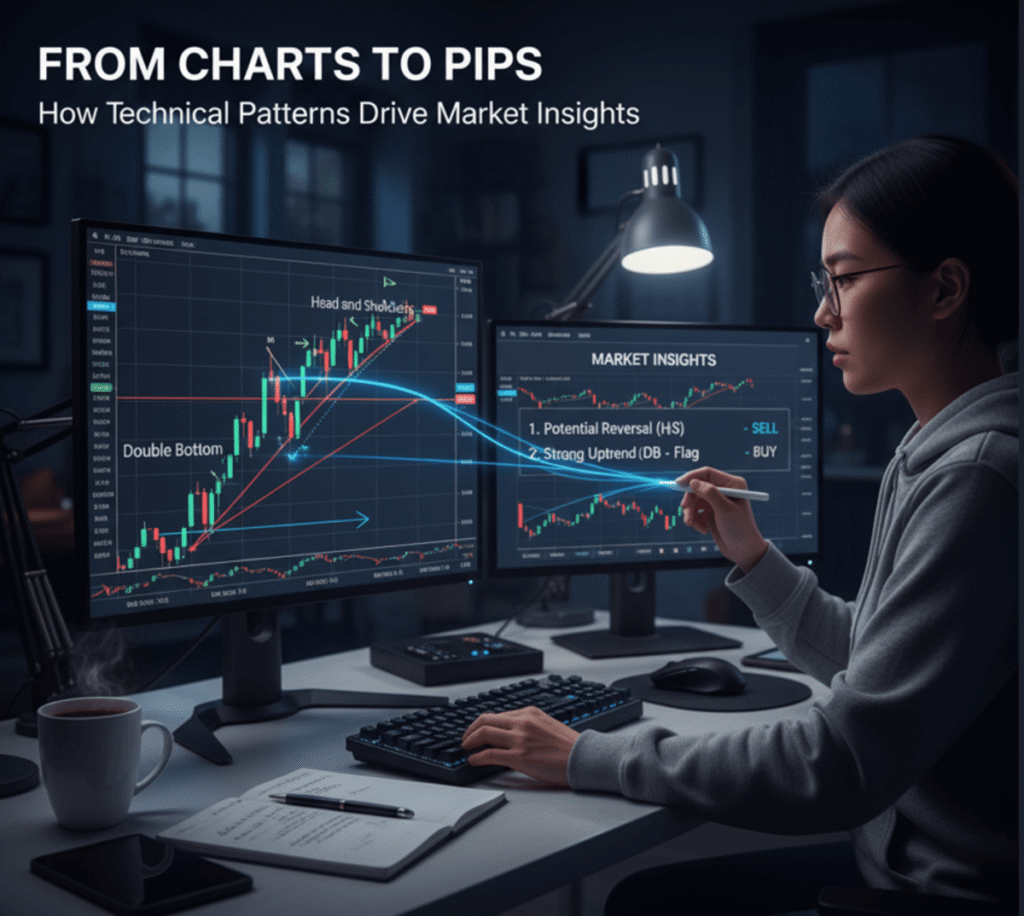

In forex trading, charts are more than just lines, candles, or price ticks. They are the footprints of traders’ psychology—the story of buyers and sellers battling for control. Among the most powerful tools in a trader’s arsenal are technical patterns, recurring formations on price charts that hint at where the market may be headed next.

Understanding these patterns is not just theory—it’s a way to forecast how many pips you can gain (or lose) from a move. If you can read technical patterns with confidence, you can anticipate big market shifts, ride trends, and avoid common pitfalls that trap beginners.

Key Summary

- Technical patterns are the footprints of trader psychology on the charts.

- The most effective ones include head and shoulders, double tops/bottoms, triangles, flags, pullbacks, and breakouts.

- Translating these patterns into pip insights helps you identify opportunities, measure targets, and manage risk.

- Success comes not from spotting patterns alone but combining them with risk management, timing, and confirmation.

Why Technical Patterns Matter in Forex

Technical patterns matter because they simplify the chaos of the market. Instead of reacting emotionally to every tick, patterns give structure:

- They identify entry and exit zones.

- They predict likely pip movements.

- They help filter noise so you focus on high-probability trades.

The reason patterns work is simple: markets are driven by human behavior, and humans often react in predictable ways. When price forms a head and shoulders, double top, or flag, millions of traders across the world see the same thing and respond in similar ways. That collective reaction is what makes technical patterns reliable.

For a forex trader, that means translating chart shapes into pip insights—knowing where the market might go and how many pips are on the table.

Key Technical Patterns That Drive Pip Movements

Here are the most powerful technical patterns and how they can translate into pip opportunities:

1. Head and Shoulders (Reversal Pattern)

- Meaning: Signals exhaustion of an uptrend (or downtrend in inverse form).

- How to trade: Enter after the neckline breaks with confirmation.

- Example: If EUR/USD forms a head and shoulders at 1.1000, a break below 1.0950 could signal a drop of 20+ pips.

- Pip insight: Often produces strong reversals that deliver large pip gains.

2. Double Top & Double Bottom

- Meaning: Price tested a level twice and failed, showing market exhaustion.

- How to trade: Wait for the break below support (double top) or above resistance (double bottom).

- Example: GBP/USD forms a double top at 1.3000. A break below 1.2950 may trigger a 30–120 pip move down.

- Pip insight: Reliable for medium-term traders seeking clean reversals.

3. Triangles (Continuation or Breakout Pattern)

- Meaning: Price consolidates before a breakout.

- Types: Ascending (bullish), Descending (bearish), Symmetrical (neutral).

- How to trade: Enter at breakout with volume confirmation.

- Example: USD/JPY consolidating in a symmetrical triangle near 150.00 may break out with a 200+ pip move.

- Pip insight: Excellent for catching explosive trends after periods of consolidation.

4. Flags & Pennants

- Meaning: Short pauses in a trend before continuation.

- How to trade: Enter when price breaks the pattern in the direction of the trend.

- Example: XAU/USD rallies $40, forms a flag, then breaks higher for another $50 (500+ pips in gold terms).

- Pip insight: Perfect for day traders and scalpers looking for sharp bursts of momentum.

5. Support and Resistance Breakouts

- Meaning: Price finally breaks through key levels traders were guarding.

- How to trade: Wait for retest confirmation to avoid false breakouts.

- Example: EUR/USD struggles at 1.0900 for days, then breaks to 1.0950 with strong volume—50 pips in hours.

- Pip insight: Breakouts from major levels can deliver multi-day pip rallies.

6. Pullbacks (Trend Continuation)

- Meaning: After a strong move, price retraces slightly before continuing.

- How to trade: Enter during the retracement near support or moving averages.

- Example: USD/CHF trends higher, pulls back 40 pips, then rallies 120 pips.

- Pip insight: Gives low-risk, high-reward entries into established trends.

Common Mistakes Traders Make with Technical Patterns

- Even though patterns are powerful, many traders fail because they:

- Enter too early: Jumping in before the breakout is confirmed.

- Ignore volume: Not checking if the breakout has strength.

- Forget stop-losses: Leaving trades open to false breakouts.

- Overtrade patterns: Seeing patterns where none exist.

The key is to balance pattern recognition with patience, confirmation, and risk management.

Turning Patterns into Pip Insights

Here’s how to make technical patterns work for your pip goals:

-

Measure Pip Targets

Use the height of the pattern to project the potential pip move. For example, if a triangle’s base is 100 pips, the breakout move often equals that distance. -

Set Smart Stop-Losses

Place stops just outside the pattern boundaries to protect yourself from false moves. -

Confirm with Indicators

Combine patterns with RSI, moving averages, or volume for stronger signals. -

Factor Market Sessions

Patterns break more strongly during London and New York sessions due to higher liquidity. -

Use Pip Calculators

Tools like My Forex Pips Calculator help you calculate exact pip value in your account currency, so you can align your risk and reward.

Bottom Line

If you want to turn charts into pip opportunities, you must master technical patterns. These patterns aren’t just shapes—they’re the story of how traders behave and where the market is likely headed next. By combining them with pip targets, smart risk management, and tools like a pip calculator, you can consistently convert chart analysis into real pip gains.

FAQ

Q1: Do technical patterns work in all markets?

They work best in trending or high-volume markets. In very quiet markets, patterns may fail more often.

Q2: What’s the best timeframe for trading technical patterns?

Daily and 4H charts are most reliable. Shorter timeframes (15M, 5M) can work but are prone to false signals.

Q3: How do I avoid false breakouts?

Wait for a retest of the breakout level, confirm with volume, and always use stop-losses.

Q4: Can technical patterns be automated?

Yes. Many trading platforms and bots can detect patterns, but manual confirmation is still recommended.

Q5: Are technical patterns beginner-friendly?

Yes, but start simple. Focus on support & resistance, double tops, and triangles before moving to advanced formations.