Scalping is one of the fastest ways to trade forex. It’s all about catching small price moves and stacking them into profit. But for new traders, it can feel overwhelming—too fast, too risky, and too technical. That’s why I want to share 6 scalping strategies that actually work for beginners. These are simple, easy-to-follow, and perfect if you’re just starting out.

Key Summary

Scalping can be one of the fastest ways to grow a small account, but it only works if you stick to tested methods. These scalping strategies that actually work for beginners are designed to be simple, repeatable, and easy to apply in live markets. By mastering just one or two of them and combining with strict risk management, you can start building consistency as a beginner scalper.

6 Scalping Strategies That Actually Work for Beginners

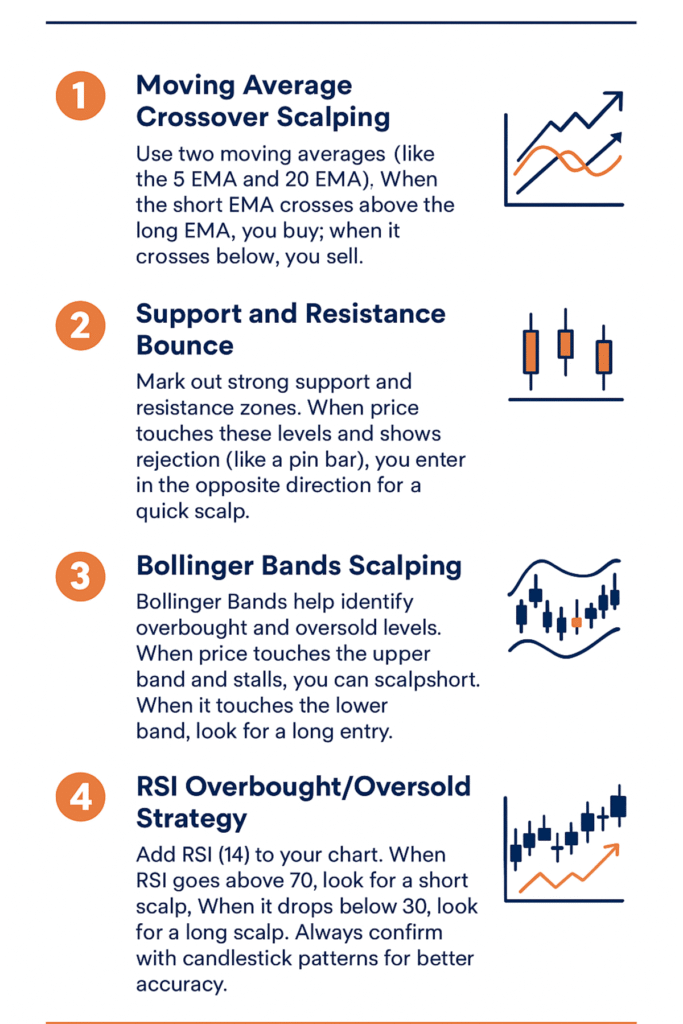

1. Moving Average Crossover Scalping

One of the simplest and most beginner-friendly methods is the moving average crossover scalping. You can use two moving averages (a fast (like the 5 EMA) and a slow (like the 20 EMA). When the fast one crosses above the slow, it signals a buy. When it crosses below, it signals a sell.

Stick to the 1-minute or 5-minute chart for best results.

2. Support and Resistance Scalping

Support and resistance zones are natural decision points for the market. When price touches these levels, it often reacts strongly. As a scalper, you can look for candlestick confirmation (like pin bars or engulfing patterns) to scalp small moves away from the zone.

This strategy is effective because it allows you to trade with clear risk levels and defined profit targets.

Works best on: Volatile pairs like GBP/JPY or EUR/USD where intraday movements are sharp.

3. Bollinger Bands Scalping

Bollinger Bands create a channel around price to show volatility. When price touches the upper band, it often signals overbought conditions, and when it touches the lower band, it signals oversold. By entering quick countertrend scalps, you can capture the small reversals that follow.

The trick is to always wait for confirmation—don’t trade just because price touched the band. Look for stalling candles or wicks before entering.

Works best on: Ranging markets with decent volatility.

4. RSI + Trend Confirmation Scalping

The Relative Strength Index (RSI) is a momentum indicator that highlights when price might be overstretched. When RSI crosses above 70, it signals overbought conditions, and below 30 means oversold. Scalpers use this to take quick reversals in the opposite direction.

This strategy is simple but effective, especially if you confirm with price action or support and resistance zones.

Works best on: 5-minute charts, particularly during peak trading sessions.

5. Price Action Scalping

This strategy requires no indicators, just pure price action. Instead of relying on complicated tools, you read the raw movement of price directly from the chart. The main focus is on candlestick patterns (like pin bars, engulfing candles, or dojis) that appear around key support and resistance levels.

Beginners should focus on one or two patterns first to avoid confusion. For example, a bullish engulfing candle at support can signal a quick scalp entry, while a pin bar rejecting resistance might be a good short opportunity. The secret to making scalping strategies that actually work for beginners using price action is patience — wait for a clear setup, enter with confidence, and exit fast before the market turns against you

Works best on: major forex pairs like EUR/USD, GBP/USD, and USD/JPY because they have tight spreads and high liquidity, making it easier to get in and out of trades quickly. It’s also most effective during high-volume trading sessions such as the London and New York overlaps, when the market is moving with more energy

6. The 1-Minute Breakout Strategy

Markets often consolidate in tight ranges before making explosive moves. By watching the 1-minute chart, you can identify these consolidations and jump in when price breaks out with volume. This strategy works well at session opens when liquidity and volatility surge.

The key is to act fast and manage risk, because false breakouts happen often. Always use a stop-loss just below or above the breakout zone.

Works best on: Major pairs (EUR/USD, GBP/USD, USD/JPY) during London and New York opens.

Bottom Line

Scalping can look intimidating at first, but if you focus on scalping strategies that actually work for beginners, it becomes much more manageable. The key is to stick to one strategy, practice it on demo, and stay disciplined. Remember: consistency is more important than speed.

Frequently Asked Questions (FAQs)

1. What is scalping in forex trading?

Scalping is a short-term trading style where traders open and close multiple trades within minutes or seconds to capture small price movements. The goal is to make small but consistent profits that add up over time.

2. Is scalping good for beginners?

Yes, but only if you stay disciplined. Scalping requires quick decision-making and strict risk management. Beginners can use scalping strategies that actually work for beginners, like the ones shared in this article, to gain confidence and grow steadily without taking huge risks.

3. How many pips should I target when scalping?

Most scalpers target between 2–10 pips per trade. The exact number depends on your strategy, market volatility, and risk tolerance.

4. What timeframes work best for scalping?

The 1-minute, 5-minute, and 15-minute charts are the most popular for scalping. They allow you to spot opportunities quickly and exit before the market reverses.

5. Do I need special tools for scalping?

Yes. Fast execution, a reliable broker, and low spreads are essential. Many scalpers also use indicators like moving averages, RSI, and Bollinger Bands to spot quick opportunities. These tools make it easier to follow scalping strategies that actually work for beginners.

6. Can scalping strategies that actually work for beginners be automated?

Absolutely. Some traders use Expert Advisors (EAs) or trading bots on MT4/MT5 to automate their strategies. However, beginners should first learn manual scalping to understand the process before relying on automation.

7. How much money do I need to start scalping?

You can start with as little as $50–$100 depending on your broker, but it’s best to use an amount you can afford to lose. Since scalping involves many trades, having a slightly bigger account helps manage risk better. Following scalping strategies that actually work for beginners ensures that even small accounts can grow steadily.